Last week we looked at development land. What it is, how you could use losses on that land against other gains, plus more. In case you missed it see here. This week our focus is on outstanding tax returns. We had two similar cases where clients that moved to us had late tax returns from prior years. The main points we will cover are

- In the red zone

- Why get them sorted

- Price

- Outcome

- Beware

The Red Zone

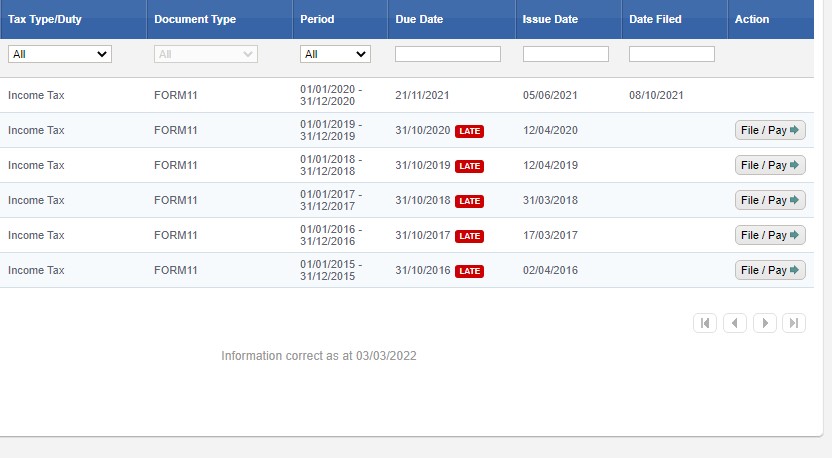

Not where you want to be. But if you are in there you need to get out. You will see from the picture that the client has Income Tax returns outstanding for the tax years 2015 to 2019. You will also see that we filed his Tax return for 2020 on the 8th of October last year, over a month before the due date. Remember the due date is the 31st of October of the current year for the previous tax year. So, you have until the 31st of October 2022 to file your Tax return for 2021. Revenue extends the due date, usually by about 2 weeks, when you both file and pay online through ROS. The due date for 2020 was later than normal owing to ROS downtime and Covid. Our two clients. Don and Juan are in the red zone, and it is our job to get them out of there or else!

Why get this sorted?

Do you enjoy getting letters and phone calls from Revenue? I wouldn’t think so. Am sure the brown envelope with the harp on it doesn’t fill you with joy and improves your day. You must get this sorted. Don & Juan are company directors, and they will need to file their returns to ensure

- They get tax clearance for their companies

- Reduce interest on the tax payable

- Help with getting a lower RCT rate

- Avoid a Revenue fixed penalty

- Clear their minds so they can focus on their businesses

Remember how vital tax clearance was during Covid for all the wage and other government schemes. If the director is not tax compliant then your company won’t get tax clearance.

The fixed penalty for not filing an Income Tax return is €1250 per return. With 5 returns outstanding Don and Juan are looking at combined penalties of €15000. Have a look at Part 1 of a defaulters list to see the fixed penalties. Click here

Price

Our price to do a very basic tax return is €500 plus Vat. If the return is more complicated, then it will cost more as it will take more of our time to complete it. Our job is to protect you and make sure it is right so you will have no issues if Revenue come calling. That would mean we charge Don & Juan €2500 plus Vat for sorting out 5 late straightforward tax returns. It doesn’t work like that as if we do 5 returns in one go, we can save time. We are doing this as one body of work over a short period. Because of this, we can reduce our fee and a typical reduction would be 20% to 30% depending on the circumstances. This would reduce our fee to €1750 to €2000 pus Vat for 5 returns. That is reasonable compared to a fixed penalty of €1250 per return or €7500 in total.

This is a cost that each client would incur anyway each year but didn’t. As always if there is a way we can write off some of our fees we will. A typical example of that would be including our fee as a deduction to reduce the profit on a rental property.

Outcome

Ludmila does most of the heavy lifting on the tax returns. She does the work and sends them to me for review or to catch her out! This is proving more difficult for me due to the quality of work that she does. We do Tax Returns this way to ensure that between the two of us we don’t miss anything. She sent me the tax returns for Don the other day. Don’s tax position was something like this.

| 2015 Tax Liability | €375 |

| 2016 Tax refund | €1200 |

| 2017 Tax refund | €600 |

| 2018 Tax refund | €750 |

| 2019 Tax refund | €1500 |

Don was in a lucky position, but it shows that he would have been better off filing his tax returns on time. Owing to the 4-year rule he will not get a tax refund for 2016 and 2017. This has cost him €1800. The reason is that he can only get tax refunds going back 4 tax years being 2021, 2020, 2019, and 2018. He will get the tax refunds for 2018 and 2019 of €2250 and he can offset the 2015 liability against that. It will leave him with a net refund of €1875. A close to a neutral position after paying our fees.

Don is lucky as he didn’t have other income outside of salaries, so he avoided the extra costs of filing late.

Beware

As a company director, it is vital that you file your Income Tax return on time. The surcharge is more penal. See here for an earlier blog on this. If your tax returns are late you are exposing yourself to surcharges, interest, and penalties. The surcharge is

- 5%, if your return is less than 2 months late

- 10%, if your return is more than 2 months late

And remember the 2-month period runs from the 31st of October date and not the extended date in November. So, the higher your tax liability the higher the surcharge. Revenue will also charge you interest at 8% per annum and if that is going back a few years then it can get nasty. This is not a place where you want to be. If you are, then plan to get yourself sorted and move on.

Summary

In general, there is a huge level of compliance with Revenue. If you are serious about your company and business, you will file your tax returns on time every time. Not just Income Tax returns but all tax returns. And know they are right. You will be making sure you pay Revenue no more than you should. Plus, you can focus on your business knowing that everything is ok if Revenue come knocking. Stay clear of the Red Zone.

Need the type of service where you never have outstanding tax returns? Call Deirdre on 051396703 or start here

I agree with your point of view, your article has given me a lot of help and benefited me a lot. Thanks. Hope you continue to write such excellent articles.