What can I claim VAT back on is a common question posed to us. The bookkeeping team here is well-versed in claiming VAT back for clients. They do this every two months for most clients and VAT can be quite a complex area with all the different rules.

There will always be queries when it comes to VAT. The aim for us is to minimise our client’s VAT payments by making sure we claim everything we can. But protecting clients too, knowing that everything is right with the correct backup. Let’s look at

- VAT Registration

- Invoices

- Claim Back VAT

- EU Purchases

- Outside EU

- Cars

- Summary

VAT Registration

Are you registered for VAT? If not, should you be? The VAT registration thresholds changed from the 1st of January 2024. The new turnover or sales thresholds, over 12 months, to register are

| Supply of services | €40,000 |

| Supply of goods | €80,000 |

| Supply of goods and services | €80,000 |

| Acquiring goods from the EU | €41,000 |

Say you provide a marketing consultancy service. If the turnover every month exceeds €3,333 then you should register for VAT. You will then charge VAT on your sales but can claim VAT back on your business costs.

When to register

William Power has a growing client list for his carpentry business. His sales in January 2024 were €3,000. He picked up some new clients and his sales in February will be €3,500. March is looking good with sales set to increase further to at least €4,000 per month. He should register for VAT from the 1st of March 2024. He would charge VAT on his sales from then but claim VAT back on his costs.

When registering for VAT with Revenue there is a two-tier system. Domestic registration should be straightforward. But if you have an EU element, as in buying or selling goods/services to EU countries, it can be problematic. Revenue are reluctant to give out VAT numbers too quickly unless they have done their checks. They will request backup documentation and it can take a while to get.

Invoices

To claim VAT back you need a proper VAT invoice. That’s not a statement, a quote, or a delivery docket. A valid VAT invoice will have certain information on it, but it should at least have

- The date

- A unique sequential number

- Supplier name, address, and VAT number

- The customer’s name and address

- Quantity and type of goods supplied

- The extent and nature of services supplied.

- VAT exclusive price

- The payment amount net of VAT

- VAT charged at different rates

- The total VAT charged

- The total price including VAT

On some occasions, you won’t have all the information above. Willie buys diesel at his local Applegreen but his name and address are not on the receipt. But most of the other information will be. Once he has that invoice he can claim the VAT back.

Claim Back VAT

Willie has an old van that’s on its last legs. His local Renault garage has been onto him, and his lips are salivating at the prospect of a new van. Heating, and a radio that works, not to mention electric windows. He’ll be the whole man driving into the local builder’s suppliers. Unsure if he should buy it on Hire Purchase [HP] or lease it, he gives us a call. If he buys it on HP, he will get the VAT back upfront.

| Net cost of van | €30,000 |

| VAT x 23% | €6,900 |

| Total cost | €36,900 |

He pays a deposit of €6,900 and finances €30,000 over 4 years. Once he’s VAT registered, he will be able to claim the VAT back in full. The date on the invoice should be 1 March 2024 or a date after that. If he bought the Van when he wasn’t registered, then he wouldn’t get the VAT back. So, he will pay a deposit of €6,900 when buying the van in March. And he will claim the VAT cost in his March/April 2024 return. The due date for that is the 23rd of May.

If Willie leases the van, he can’t get the VAT back upfront but over the primary lease period. Over 4 years the monthly lease cost, including VAT, is €769. This is

| Net monthly lease payment | €625 |

| Vat x 23% | €144 |

| Total | €769 |

With the lease option, he would claim the March and April VAT amount, a total of €288, in his first VAT return in May. By purchasing the van outright or getting a loan or HP he can claim the full VAT cost upfront. With leasing no. But there are other tax advantages to leasing.

Other Costs

Willie can also claim VAT back on a lot of his other costs to include

- Diesel

- Phone

- Broadband

- Repairs

- Advertising

- Light & Heat

- Rent for commercial premises

- Accountancy Fees

- Materials

- Equipment & tools

- Cars for business use

The key for Willie is to have a quality bookkeeping process in place. He’ll need to up his game to ensure he keeps proper books and records. Cloud accounting with Dext and Xero will help with this. Having all the invoices which he claims VAT back on is key. Revenue will look for these. Especially when there is a larger than normal VAT reclaim.

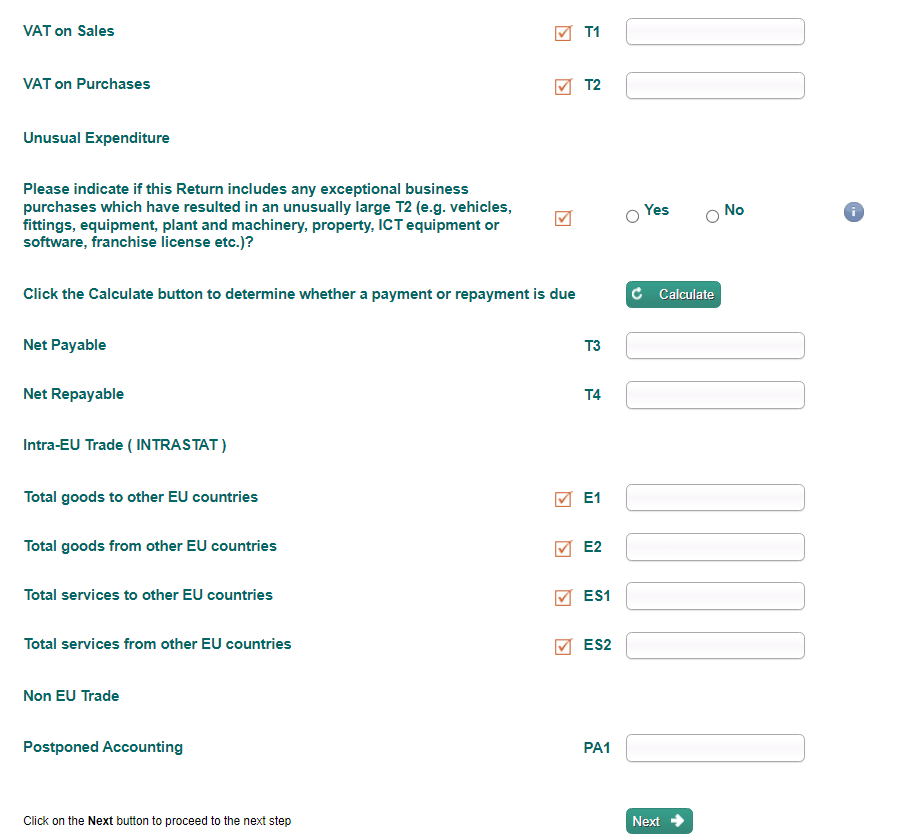

There is a box to tick on the VAT return if you bought an exceptional item that leads to a larger refund than usual. We find that when we tick that box we always get a follow-up query from Revenue looking for the top ten invoices. It’s like inviting Revenue to a party with free beer, food, and brilliant music. They will turn up!

Can’t Claim VAT Back

It’s also important to know what you can’t claim VAT back on. While we don’t have a definitive list some of the following would be common

- Petrol unless stock in trade

- Insurance costs

- Bank fees

- Education & Training costs

- Food – unless you have a food business

- Hotel accommodation unless for a qualifying conference

- Entertainment costs

- Rent – residential premises

- Personal expenses

Growing Business

Roll on 2 years to 2026 and Willie’s business has grown threefold. He has employees and rents a warehouse to store equipment and tools. Paying €1,230 a month which is €1,000 net an VAT of €230. He can claim this VAT back on this and should have a monthly invoice to support the claim. When renting commercial premises you will know if you are paying VAT or not. There should be a VAT clause in the lease. Once it’s for the business and you have a proper invoice then you can claim the VAT.

EU Purchases

Many businesses source materials and equipment from other EU countries. If you are buying these from a VAT registered business, you supply them with your VAT number. It’s up to the supplier to verify your VAT number. Once they are happy it is legitimate, they shouldn’t charge you VAT. Known as a business-to-business [B2B] purchase, special rules apply to this transaction. You treat this like a sale and a purchase in your return.

Willie sources a special type of cutting saw in Italy for €5,000. He gives his VAT number to the Italian supplier who verifies it. There is no VAT on the invoice. Willie must self-account for the VAT on his return at the rate of VAT for the saw. It would be 23% in Ireland, so the relevant part of his return looks like this

| VAT on sales | €5,000 x 23% | €1,150 |

| Less VAT on purchases | €5,000 x 23% | €1,150 |

| VAT cost | €0 |

So, it’s a neutral cost for Willie but important he records it correctly. If Willie was charged VAT from an EU country, in error, he could apply for a refund. There’s an Electronic VAT Refund system available on ROS.

Outside EU Purchases

When buying goods from outside the EU, VAT is due at the point of importation. The VAT cost will be on the documentation that the importing agent looks after. This includes business purchases from mainland UK but not Northern Ireland. If you pay this VAT on importation, you can claim the VAT back in your return.

You can avoid the upfront VAT cost by availing of postponed accounting. Again, it’s important that the paperwork is right and that you can qualify for this. There is a cashflow saving here. If Willie buys the saw from the UK he would pay the VAT of €1,150 when buying it. He would get the VAT back but only when he does his return and provided Revenue are in a good mood. Revenue are unhappy with the way some businesses record these transactions.

Cars

Normally, you can’t claim VAT back on cars, unless they are stock in trade, a driving school, or a car hire business. But it’s possible to claim back 20% of the VAT cost of a car provided you use it for 60% business use.

Business use is using it for your business activities. Willie hires Pat, a QS, and buys a company car for him as he will be travelling from site-to-site pricing jobs. The details are as follows

| Cost of car | €50,000 |

| VAT included | €8,000 |

| VAT reclaim 20% | €1,600 |

If Willie sells the car within 2 years, there will be a clawback of some of the VAT claimed. Outside of 2 years, there is no clawback.

Summary

What you can claim VAT back on is very much business-specific. If you are VAT registered, then you’ll be able to claim the VAT back on most of your business purchases. The key to maximising your VAT reclaim is to have quality paperwork. Missing invoices means missing out on thousands of euros. If you are happy donating money to Revenue, you are a very kind person.

While you may be kind you are clever too. You will want to ensure your VAT returns are right and payments kept as low as possible. Claim everything you can, when you can, but be ready if Revenue come calling.

Getting your VAT right is part of a quality bookkeeping process. To find out how we can help you, start here

Pingback: Business Problems Create Personal Problems - Comerford Foley