We investigate the weird world of tax credit certs for 2023 and the stranger things we have seen this year.

When I say weird, I mean taxpayers expecting to see an increase in their net take-home pay. But the opposite happens. They get less and a lot less as you will see. We will go through

- Introduction

- The basics

- Splitting between spouses

- Other Common Issues

- Getting help

Introduction

Noel Gordon Canty is a lecturer at the new South East Technological University [SETU]. He is very intelligent and good at his job. He’s not a tax lecturer. A Chelsea fan at heart. Known to his mates at Noel Go Canty, his heart died a little last week with the reappointment of Frank L as the team coach. It’s on an interim basis but the fear is he’d do well for a few games and make a balls of next season.

Noel came to us in February a touch perplexed. He got paid in January but what he got was a lot less than he thought. There were big tax chunks gone to the government. His net take home was way lower than what he got last December. He knows things changed a bit as he hit 66 in 2022 so was getting the State Pension. With all the budget changes he didn’t expect it to be too bad.

What made it worse was that his wife Raquel was in a similar boat to him. She’s a secondary school teacher, was getting way less too, and not happy about it. He sent through his tax credit cert for 2023 and I couldn’t believe what I saw. Is this for real was my first thought. Before we get to the reason for my disbelief, let’s look at some basics.

The basics

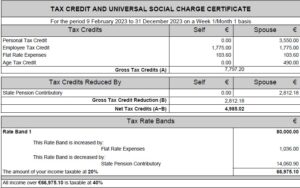

Ok the basics are that we have 3 columns with the headings

- Tax Credits – Self and Spouse

- Credit Reduced By and

- Rate Bands

Tax Credits – Self and Spouse

Under this heading, you will see the tax credits are

| Personal Tax Credit [Married] | €3550 |

| Employee credit €1775 x 2 | €3550 |

| Flat rate expenses | €88 |

| Age credit | €490 |

| Total | €7678 |

Nothing untoward here and the only item of comment is the flat rate expenses. The numbers are wrong. You will see from the Tax Rate bands column that flat rate expenses are €440. In cash terms, Noel’s flat rate expense is €376 [€75.2 x 5] and Raquel’s is €64 [€12.8 x 5] We add €376 and €64 to give us €440. I hear you asking why you multiply by 5.

A flat rate expense increases our lower rate band by the amount of the expense. Our lower rate band is 20%. So, if we get €500 that increases our lower rate band and it is worth €100 to us as a tax credit. The number for Noel is wrong as the flat rate expenses for a college lecturer is €518. This would be a tax credit of €104. It is also €518 for a teacher, so another €104 for Raquel. Flat rate expenses for both should be €1036 and not €440. A small difference but worth an extra €120 to them.

Correct Tax credits will be

| Personal Credit | €3550 |

| Employee €1775 x 2 | €3550 |

| Flat rate €104 x 2 | €208 |

| Age | €490 |

| Total | €7798 |

Tax Credits Reduced By

This is the column where the figures made my jaw drop. You will see that the total tax credits in column 1 came to €7678. This column reduces the tax credits by €39252. Not only does Noel have no tax credits but he owes Revenue €31574! Remember tax credits are cash and now the Cantys have none. With no tax credits the tax liabilities will be higher.

Tax Rate Bands

The lower rate band of 20% is €80000 for a married couple/civil partnership for 2023. You will see the lower rate band increases by the flat rate expenses of €440. All ok there. The baffling thing is that Revenue thinks Noel is getting a State Pension of €196259. Don’t know where they got that from! Was the computer that prints these out after having a heavy weekend on the sauce? Per Noel, his state pension is €14060 a year.

The effect of this wipes out the Canty’s lower rate band. You will see from the column underneath that all income is taxable at 40%. So, no lower rate band and no tax credits. Assuming a monthly salary of €6000 the effective tax rate would be about 48% or €2880. Raquel is in that same boat. You could understand why they’d be cranky about this.

What it should be

What it should be is that the tax rate band reduces by the pension.

| Lower rate band | €80000 |

| Increase by expenses | €1036 |

| Reduce by State Pension | €14060 |

| Adjusted lower rate band | €66976 |

To collect the tax on the State Pension the tax credits would reduce by €2812

| State Pension | €14060 |

| Tax at 20% | €2812 |

| Tax credits reduction | €2812 |

| Tax due | €0 |

Reducing the correct tax credits of €7798 by €2812 leaves them with net tax credits of €4986

Splitting between spouses

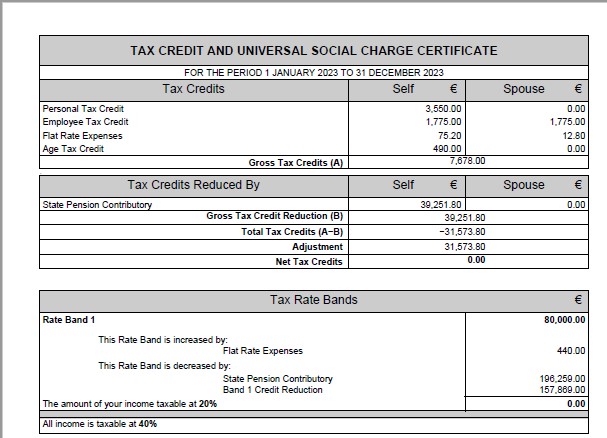

Revenue issued an updated Tax credit cert to Raquel on the 10th of February 2023. The numbers were right but there was still something amiss. See below.

In the Tax credits column, you will see that her tax credits are €1879. The second column ‘Tax Credits Reduced By’ shows the total credits of €4985, as mentioned above. As Raquel gets €1879 that leaves a balance of €3106 for Noel.

The third column shows the Tax Rate Bands. Income Taxable at 20% is €66975. Of that amount, Revenue allocate €31518 to Raquel leaving a balance of €35457 for Noel. So, the first €2955 of Noel’s monthly salary is at 20%. Plus, he has a monthly tax credit of €259. What would his net monthly salary look like now?

| Monthly Salary | €6000 |

| First €2995 x 20% | €591 |

| Next €3045 x 40% | €1218 |

| Total Tax | €1809 |

| Less Tax credit [€3106/12] | €259 |

| Net Tax liability | €1550 |

| Add PRSI/USC 8% | €480 |

| Total Tax liability | €2030 |

This is an effective tax rate of 34% compared to 48%. A tax saving of €850 per month. Noel’s net after tax is €3970. Plus, he will get the state pension of €1172 per month. Remember, Revenue already collected the tax on this. As such, he has €5140 in cash every month. A few bobs to get him over to Stamford Bridge to see Frank work his magic on the Chelsea strikers.

Other Common Issues

The main other common issues with the Tax Credit Certs is the allocation of credits and the lower rate band. When an employee leaves one employer and starts with another, things can go awry.

Allocation to wrong employer

I have seen this on a few occasions. One case was a family member retiring. She left her employment but getting an employment pension from a “new employer”. Revenue had given her a married tax credit of €112 instead of €3550. To make matters worse they had allocated all her lower rate band and tax credits to her former employer. As a result, she was in the same position as Noel & Raquel, paying tax on her pension at the top rate with no tax credits.

Week 1/Month 1 or Cumulative

You will see on Raquel’s tax credit cert for 2023 that it is on a week 1/month 1 basis. That means she gets a fixed lower rate band and tax credit for each week or month that she gets paid. She overpaid tax for the first few pay periods of 2023. When a cert issues on a week 1/month 1 basis it doesn’t deal with the issue of prior overpaid taxes. The cert needs to be on a cumulative basis. On a cumulative basis, if there are overpaid taxes, she would get a refund for those overpaid taxes.

Because of this we had to get back to Revenue to issue her tax credit cert for 2023 on a cumulative basis.

Credits too high

Tax credits can be too high also. We would often see a tax credit of €200 or €400 for medical insurance tax relief at source. The employer doesn’t pay this, so the employee isn’t entitled to the credit. It would be common where an employee had this as a BIK with an employer. They move employment and don’t have it with the new one.

Getting Help

As it is the age of technology Revenue want everyone to go onto myAccount. If you can do this it is the best way to sort things out Otherwise it is phone calls and endless waiting. The most important things are to

- Understand what your tax credits and expenses should be

- Know what your lower rate band should be

- If you have other income, like social welfare, is that correct

- Are your tax credits and lower rate band allocated to the right employer or pension provider

- Is your tax credit cert issued on a week 1 or cumulative basis

It’s very frustrating to not get the correct pay and then you have to waste time and resources sorting it out. If this is going on for a few years then Revenue will owe you money. Don’t leave the Stranger Things go. Be like Noel Go Canty and sort it out.

If you are tearing your hair out with this and need help, Start here

Pingback: Payroll - It isn't Easy - Comerford Foley