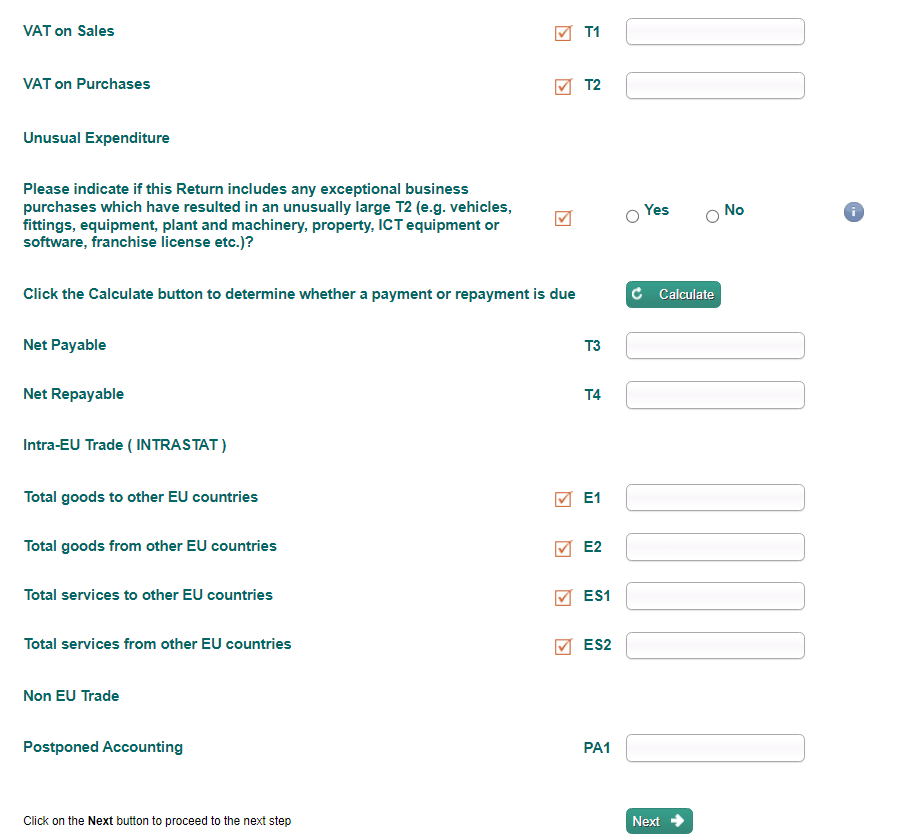

What can I claim VAT back on is a common question posed to us. The bookkeeping team here is well-versed in claiming VAT back for clients. They do this every two months for most clients and VAT can be quite a complex area with all the different rules. There will always be queries when it

That nagging 'what if' about your finances? It's costing you growth.