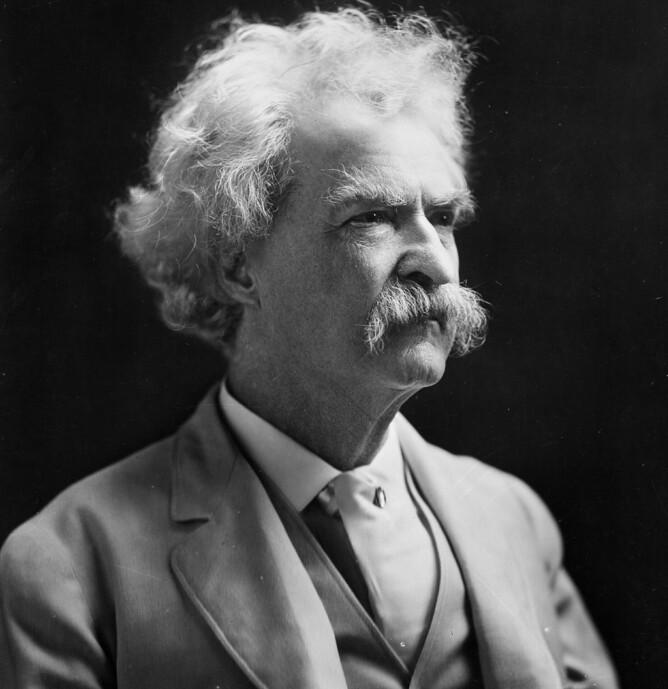

“The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin”. Mark Twain Last week we spoke about things you need to know when setting up a company. In case you missed it read here We are now into the thick of Tax return filing season. Corporation Tax [CT]

That nagging 'what if' about your finances? It's costing you growth.