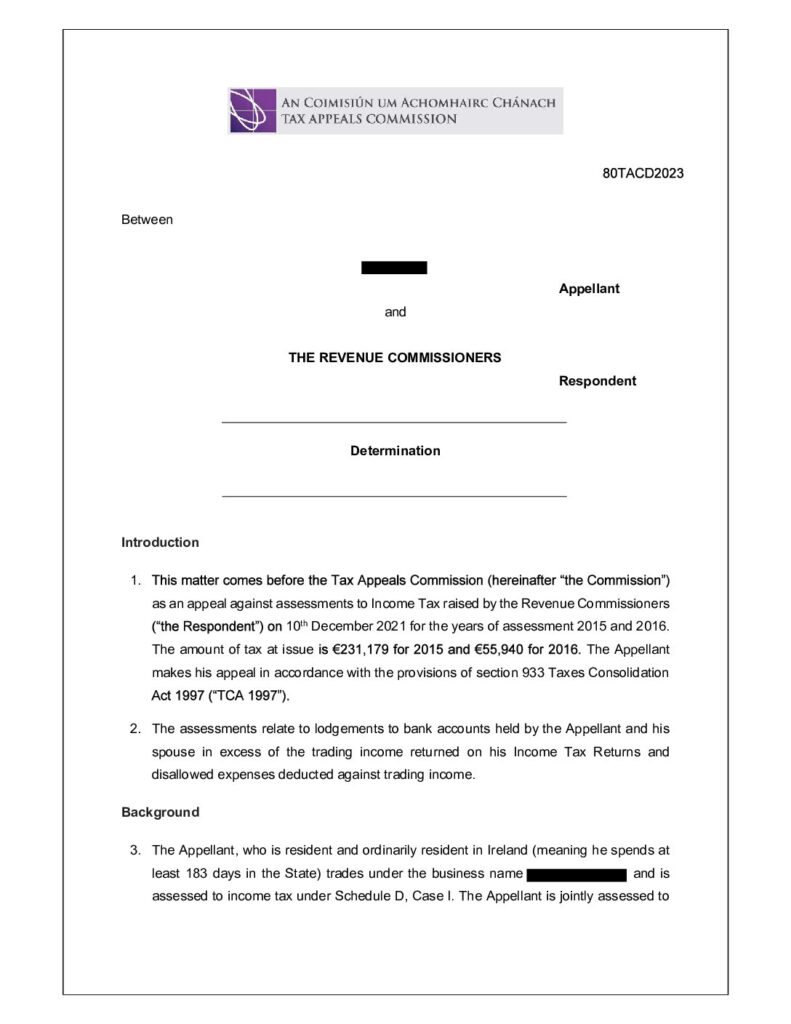

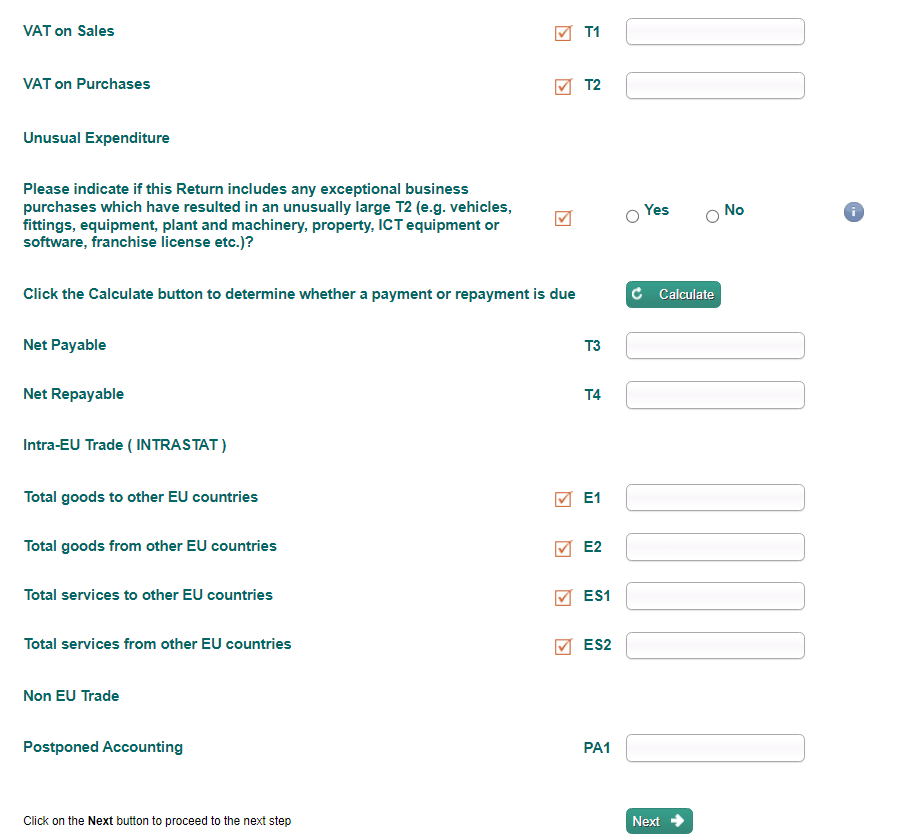

Revenue Risk Reviews. Oh no, I must be in trouble! A Revenue risk review letter hits the ROS inbox on a Friday morning. OMG, that’s the last thing I need, as I am heading off to the match in Galway for the weekend, thinks Mary Boone. But in the back of her mind, she knew

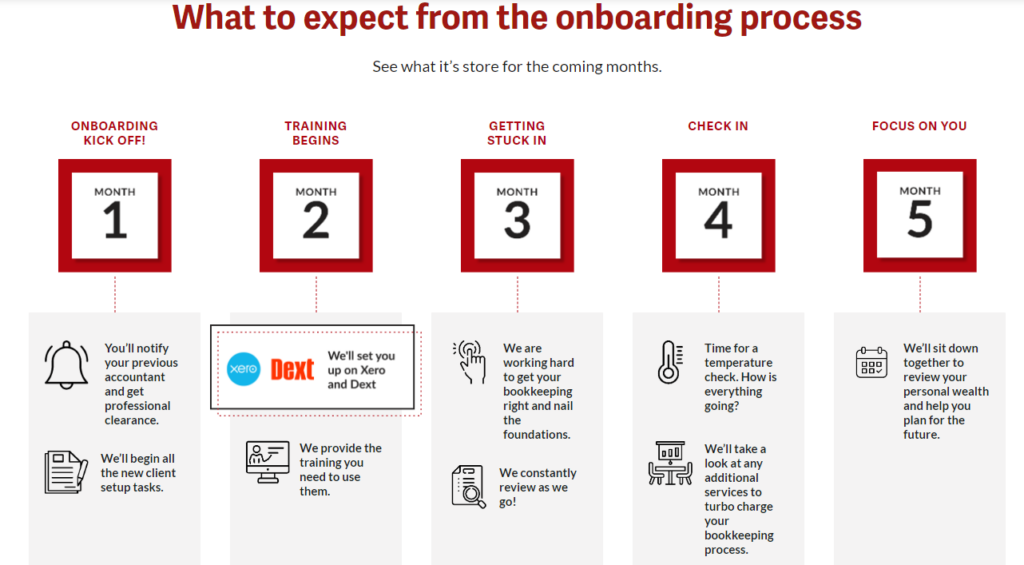

That nagging 'what if' about your finances? It's costing you growth.