Mary O’Leary had a Revenue Profile Interview earlier this month. Mary is an auctioneer. It was mid-July and Mary was sitting in her office after her morning coffee on the seafront. Pat, the friendly postman, drops the day’s mail on the desk, and off he saunters again. Mary has half switched off as her holiday in Spain is on her mind. She still has a few bits to get and must head into town at the weekend to sort it.

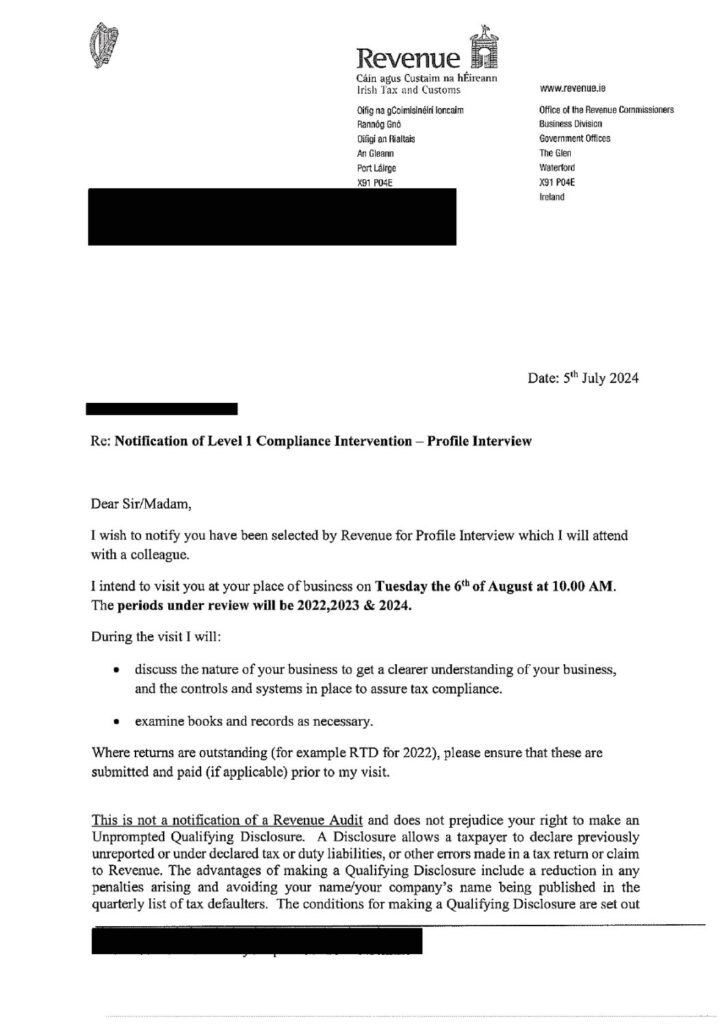

She notices the brown envelope mixed in with the usual bills and bank letters. There is a harp on it. Ok, it’s from Revenue and she wonders what do they want now. Half in fear she opens the envelope. The opening words of the letter read

” I wish to notify you have been selected by Revenue for a Profile Interview which I will attend with a colleague”

Let’s delve a bit deeper into this to understand

- What’s a Profile Interview

- Preparation

- The Interview

- The Results

- Lessons Learned

What’s a Profile Interview

A profile interview is an interview by a Revenue official at your place of business. They do it to become more familiar with your business and the taxes you are responsible for. You’ll see from the letter that it’s a Level 1 compliance intervention. As such, Revenue haven’t identified a particular risk area and are coming to get you.

It could be that they noticed something in your tax returns that was a red flag. Or they are looking at a particular industry, like auctioneers. This is to identify risk areas and review the levels of tax compliance in that industry. If they find an area of concern in the interview, they can escalate to a Level 2 or Level 3 intervention. In light of this, you should be well prepared.

Preparation

Good preparation will help the taxpayer be more comfortable in the interview. It’s like reviewing of all your taxes to see what the up-to-date position is and identify any areas of weakness. The periods under review for Mary are 2022, 2023, and 2024. The first thing we do is get Cathy on the job. After that, it’s a phone call with the Revenue official Tom.

The purpose of that is to find out about the reason for the interview to see what triggered it. Also, it’s to let him know that we’ll be helping the client prepare and it’s a help to us to know the main focus areas of Revenue. I had a call with Cathy and my view is that Mary’s company Pent up Demand Ltd is very clean. Despite that, let’s not assume everything is ok so we need to spend time reviewing the different tax heads.

On the call, Tom didn’t divulge a lot, but he mentioned the level of expenses in the 2022 accounts being quite high. Ok, so at least we know now that expenses is top of the agenda.

Review the Tax heads

In Mary’s company, the main tax heads are PAYE, VAT, and Corporation Tax.

PAYE

For PAYE we looked at the PAYE control account opening and closing balances. This is to see if they match the payments to Revenue. We also looked at the Wages Gross to Net report. This is to see that the Director’s and employees’ salaries tie in with the numbers in the accounts.

We got a few expense claims from Mary to see the level of detail on them like

- Business kilometres travelled

- Rate per kilometre used

- Purpose of the journey

- Destination and starting point

The only thing we identified was an incorrect rate per kilometre used for one claim

Corporation Tax

For corporation tax, we didn’t find anything wrong but checked

- Corporation Tax returns filed on time and payments up to date

- Adjusted profit computations were all ok. Addbacks for depreciation, client gifts and entertainment, and deductions for capital allowances.

- Close company surcharge ok

VAT

We looked through the VAT control account to ensure opening and closing balances tied in with payments. We also looked at

- VAT on sales during the years in question

- The VAT on letting fees

- VAT on purchases

Looking through everything there were a few minor issues to fix like

- There was no VAT returned on one house sale and

- VAT incorrectly claimed on some entertainment costs

The Interview

The interview day arrives on the morning of the 6th of August at 10 am. Cathy meets Mary beforehand to run through a few things like the VAT and expenses. She’ll sit in on the interview with Tom. It makes sense that your advisor is at the meeting with you. They will be more familiar with the taxes and books and records while you’ll know more about the business.

As they say, two heads are better than one. Plus, it’s a great support for the business owner knowing they have someone in their corner. Answering those questions that an accountant will be comfortable with. Plus, having the background knowledge of the tax heads.

After the introductions, Cathy confirms she has looked over the various taxes. She mentions the VAT and the incorrect rate for an expense claim. An initial confession of sins! It’s not something that merits a qualifying disclosure, but we will fix it and pay whatever is owed.

First Part

The first part of the interview was understanding more about the business. That included questions about

- The ownership structure

- Was it a cash business

- The normal place of work

- Type of work

- Employees. How many and their roles

- How a sale is recorded

- How a letting is recorded

- How do you account for VAT & PAYE liabilities

- Is the form 8-3 up to date

- Systems for VAT & PAYE

- Are there EU purchases of goods or services

- Is there VAT on the rents

Tom looked for a copy of a lease agreement to check the VAT status. Mary showed him a few sales on the Acquaint system they use

Next Part

The next part focused on the employees and the expenses. Tom looked for a register of employees. There were only 3 employees. While Mary didn’t have a register she had contracts, dates of starting, and of leaving. All the information is on the payroll package too.

Tom mentioned the level of expenses in the 2022 Corporation Tax return was high compared to the sales number. He wanted to know the reason for this. Mary knew the reasons and explained them very well to Tom. She was working closely with a property developer from Kildare who was launching 40 houses in Greystones. There were several meetings at his head office in Naas. Plus, there were a few sales in Wexford that didn’t go through for different reasons. These got to the final stage but didn’t happen due to planning, maps, etc.

Tom looked for 3 expense claims for 2022 and 2023. He wanted to know

- Where the journey began from – office or home

- The distance from the office to the business destination and back.

- The kilometre rate used

- Purpose of the journey

Also of interest was the sign-off procedure for expenses. Was Mary signing off her own expense claims or did the other director sign them off?

Paperwork

Cathy had a lot of paperwork ready for Tom and what she gave him included

- Sales Reconciliation for 2022 and 2023

- Wages reconciliation for 2022 and 2023

- 3 samples of 2022 mileage claims

- 3 samples of 2023 mileage claims

He also wanted nominal ledgers for 2022 and 2023, and extended trial balances for both years. Plus, journals and summaries which we didn’t have but will get to him by the end of the month.

The Results

And here are the results of the Revenue jury! Not guilty. All was good bar a few issues to tidy up that we mentioned already. He was very happy that there was a computerised system to record the sales and lettings. Those that manual systems would be an area of concern for him.

Another area of mention was the different bank accounts that Mary used to pay VAT & PAYE. For example, when a payment came in for a house sale Mary transferred the VAT element to a VAT bank account. From a Revenue perspective, it delighted him to see that. The taxpayer was conscious about paying their taxes and set aside the tax amount into a separate account. Top marks for Mary.

The expenses review was all good too as he understood the reasons why they were higher in 2022. While the paperwork stood up to scrutiny the signing-off process needs to improve. They don’t want a situation where a company director signs off on their own expenses.

Lessons Learned

There are plenty of lessons learned from a Revenue Profile Interview. Areas of weakness for Mary were the register of employees and the sign-off of expense claims

Good preparation for the interview and being there with Mary on the day helped a lot. Sure, it’s not every day you have the honour of a Revenue official calling to your business. You want and need that support so everything can run as well as possible. The preparation piece is vital, so you know the areas of weakness before the interview starts. If there are liabilities that come to light beforehand you have two options

- Going down the qualifying disclosure route. Pay what’s owing plus interest and a small penalty, in most cases, but you avoid publication or

- Self-correct the tax returns once you are within the timelines to do so.

Questions for you?

There are a few questions for you to consider if you get a Revenue Profile interview. Will I have the support of a quality accountant who has experience with Revenue to help me through it?

Are my books and records computerised and of high quality, so I have all the information that Revenue need?

When you think of it. Your company pays tax at 12.5% Why would you not have a quality bookkeeping system in place? You are so busy with your business, that not having the numbers and systems right is a potential nightmare. By investing in your numbers and choosing a quality accountant, it won’t be an issue when Revenue come calling.

As for Mary, she was happy out. She got away to Spain after with her sombrero and new style. She even made a secret toast to Cathy with a nice glass of Rioja overlooking the harbour in Marbella.

Need help with your company to ensure everything is right? If so, start here