With bookkeeping do you need help? Gone are the days when one person can keep on top of all the changes coming thick and fast. Arriving like an express train into your inbox from the well-oiled Revenue machine. Let’s look at

- What is bookkeeping?

- Current system

- The good, the bad & the ugly

- Time for change

- What do you get with CF?

What is Bookkeeping?

What is bookkeeping? Hard to know the exact right answer but it means keeping proper books and records for your business. It’s a legal rule. Books and records all sound very paper based. Big folders of sales and purchase invoices and bank statements taking up space.

But what are these books and records for? These are documents that show your sales and expenses/purchases/costs. If you have sales of €650,000 then you have the sales invoices to support that number. All invoices to different customers showing the net price, the VAT, and the total price.

Likewise for your costs. For many businesses payroll is a significant cost. You have all the payslips, payroll reports, and tax credit certs for your employees. The PAYE payments to Revenue and a host of other backup for pension and expense payments. Have you all your invoices for material and other business costs?

All the numbers from your bookkeeping will flow into your annual accounts.

Bank Reconciliation

Bank reconciliation is a way to double-check your bookkeeping. You do this by comparing your business accounts with your bank statements. Both should agree with each other.

Debtors and Creditors

Debtors owe you money and knowing who and from when is important. Creditors are those to whom you owe money to. With good bookkeeping, you will have this information to hand.

Current System

What is your current system like? Do you do it or have you a bookkeeper? Or do you outsource it to your accountants? Let’s look at the good, the bad, and the ugly.

The Good

The good is the Clint Eastwood of bookkeeping systems. Vat returns on time, every time. Payroll running smoothly with all employees getting paid on time and receiving payslips. Invoices issued after you finish the job. The bank reconciliation is there every month, and you know your debtors and creditors. To put the cherry on top you even have

- Credit control. A nice lady helping you to get the money in faster.

- A payment process for creditors. A regular payment run for invoices you have approved.

All running like clockwork.

The Bad

The Lee Van Cleef or Angel Eyes of bookkeeping systems. The opposite of the good. You or a family member likely does it and you don’t get any joy from it. Why is that? Well, you are not sure about a lot of things. There’s a bit of

“let’s give it a lash and hope for the best”

You are doing it to help out because you feel a compulsion to do it. It’s not your thing and you’d much prefer to be picking stones but! You are keeping Revenue at bay and doing your best for employees. But you have this horrible feeling inside that something could go wrong. A bit like watching a horror movie through your fingers! What are the signs of “The Bad”

- A lot of Revenue interaction. Way too much for your liking.

- Returns are late and payments are late too

- Some returns are not done at all

- No tax clearance

- Too much of your time spent on it

- Invoicing is too slow

- Unsure of who owes you money and for how long

- Double payments to some suppliers and others not paid at all

And the list goes on!

The Ugly

The Eli Wallach or “Tuco” of bookkeeping systems. To call it a system in the first place is wrong. Most people won’t be in this space but there’s always a few. There are massive holes in what is being done as you put it on the long finger or outsource it to somebody else. That somebody also has long fingers! There are more red flags and danger signs here than at a Formula 1 Grand Prix. Telltale signs of being in this space are

- Lots of outstanding VAT & PAYE returns.

- You know the lady in the Sheriff’s office and make payments to them instead of Revenue

- Accounts outstanding

- Tax returns outstanding

- Company filing dates missed

- Loss of Audit Exemption

- Surcharges, interest & penalties

In general, it’s a mess and you are hiding at the back of the couch as the horror story unfolds.

The good news here is like the song from Yazz

“The only way is up, baby. For you and me now”

This comes to a head as it has to. The business owner needs accounts and tax clearance for a host of reasons. They could be looking to buy a house, or a premises and the bank wants all the things that you don’t have.

It’s not all doom and gloom though. Often, there is a good business there despite the bookkeeping carnage. Do not doubt that there will be initial pain to sort it out. Revenue debts to clear. Phased Payment arrangements. Accountancy fees. Lots of time and costs but it has to be done. And when you do it, you won’t ever want to go back to this place.

Time for Change

Is it a time for change for you and your business? The “you” is as important as your business. After all, you are the one stressing and worrying. You are the one doing the invoicing or VAT returns at night after a long day’s work. All this paper, returns, and payments when you know, in your heart of hearts, that it’s not the right thing.

Do you stick or twist? Stick and nothing changes. Twist and you are willing to explore the opportunities out there.

Others are good at bookkeeping but don’t have the time to do it. Many business owners ace the numbers and everything is up to date. But they know that their time is more valuable elsewhere. The demands of the business are such that it becomes a necessity to outsource. You know the value of the numbers and look for a partner you can trust to take care of them for you.

Add Value

Getting a quality bookkeeping system in place adds value to your business. How is that?

A short story. A client competitor wanted to sell his business to our client. Our client was keen. He spoke with Ger and asked him what information he should ask for. Ger’s answer was the last set of accounts and management accounts to assess how the business is doing now. They didn’t have management accounts. The last set of accounts was over 18 months old. The next set wouldn’t be available for another 2 months. As a result, our client didn’t bite. That man’s business closed so he got nothing for it. Plus, people lost jobs.

There was no certainty our client would buy this business if he got management accounts. But, by not having them, the owner limited his ability to sell.

By implementing a quality bookkeeping system in your business, you add value in other ways too. You have

- Limited interaction with Revenue. And if they do come calling you have all the info to give to them

- Accounts done early

- A snapshot of your business

- Know your key numbers

- More cash in the bank with credit control

- Happy employees. Payroll aced and someone to answer queries

- All tax returns on time and payments are up to date

- Tax clearance

- Up to date numbers and accounts for lenders

- Suppliers paid on time

- Cloud based so you have full visibility

- Certainty of cost

Certainty of Cost

Not knowing the price of what you are getting is a fear for many. Having certainty of cost at the outset where everything is transparent takes away a fear. You know all the services you are getting and the price of those. In some cases, a business owner won’t know exactly what they need so it’s our job to inform them.

A recent bookkeeping client that we won had a yearly accountancy fee budget agreed. They agreed this at board level with other directors. Our fees were over their budget amount so the client took out some services that they would continue to do.

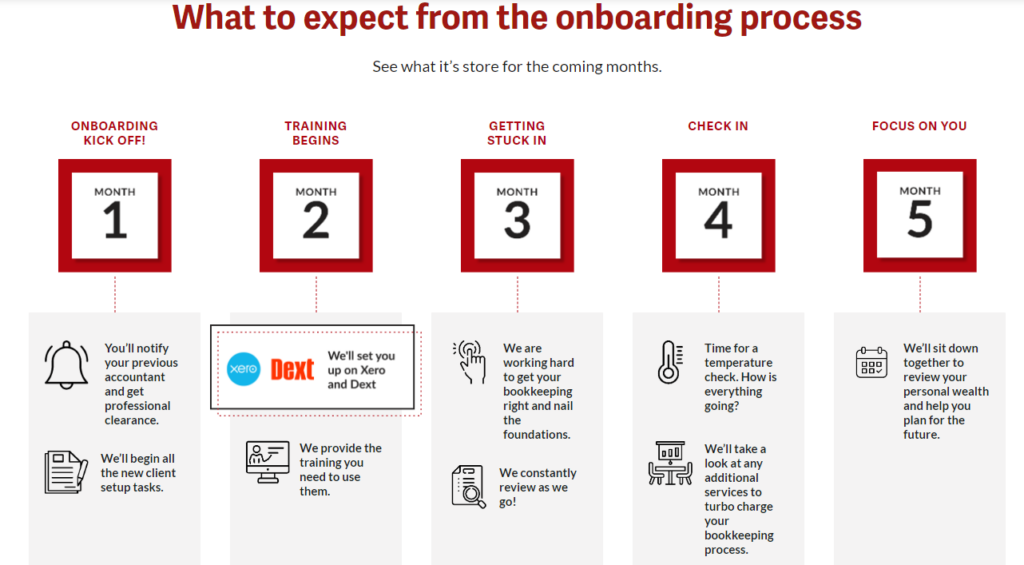

Another fear is being stuck into something and it’s not working for you. Again, we would always be happy to trial for a 2 to 3-month period to see that it’s working for the client and for us too. The reason for that time is that it takes a few months to get everything up and running. At that stage, clients can start to see the benefits.

There’s a local client here that Dee, Izabela, and Ger do great work for. His view was along these lines.

“I thought you were very dear at the start but now I know you are worth every penny”

What do you get with CF?

Apart from a quality bookkeeping process in your business, the other benefits are

- A dedicated manager who is responsive and good too

- Peace of mind. Everything is up to date.

- Less stress means more confidence.

- A partner in your business

- Quality numbers that are right and you can rely on

- A team with different skills across VAT, Payroll, Credit Control, Accounting, Cosec & Tax

- Cloud accounting with Xero & Dext. Bank feeds into Xero.

It’s a one stop shop for your business. The more your business grows the more services you need, and we’ll be there to support you every step of the way.

We are very lucky to have a great team that’s motivated and cares about our clients. Rather than me saying how good they are you can check out what our clients are saying about us.

Bookkeeping -Do You Need Help? Find out how we can help you. Start Here