Our Hero Jeff

In our last blog, we spoke about our values and what they mean to us, and how they underpin the way we work with our clients. In case you missed it see here. This week we will talk about our hero Jeff, our accountancy coach and how you can get help with growing your business. We will look at

- Our first meeting

- Why were we so impressed?

- Lessons learned

- What we don’t know

Our First Meeting

Ger and I decided to work with an accountancy coach. This was in May 2015. The reason for this was to get some help to grow our business. We were both employees in EY and started our business in 2011. Neither of us had grown a business before. No such person was working in this area in Ireland. We headed to the UK and started working with Rudi Jansen.

There were other practices from England and Scotland. We were all looking for the same thing. To get the knowledge to help us grow our business. Rudi was clever as you had to have your work done before each meeting. Our work was to have the key business numbers for the previous quarter. This was to compare them with the other practice owners in the room.

Alarms were set for 3.30 am that first Thursday morning as Ger was picking me up at 4 to get to the airport for 6. Bleary eyed and fast tracking through security for our 8-o clock flight to East Midlands. A swift taxi to the venue we arrive 20 minutes late, luckily avoiding the cringey getting to know you game. Met by a room full of strangers but all very welcoming. Our first task was to compare our numbers with the numbers of the other practices. We went to different corners of the room, markers in hand and flip charts waiting for ink. We had never done this before. All the numbers were on a sheet. Some comfort in that we weren’t the worst, but we were far from the top of the class too. That was where we saw the name Jeff.

Why we were so impressed

In our collective huddle, we examined the numbers of our own business and the others in the group. We discussed the reasons behind the numbers. Why was the previous quarter so good or so bad? If someone won or lost significant business what was the reason behind that. If someone lost money or had very high wage or fixed costs, was that typical and what were they doing to fix it.

After 20 minutes we sat down but one nominated person shared the key findings for each group. When it came to Jeff’s group the standout moment was Jeff’s numbers. Net profit was over £200,000 in a quarter. Yes, pounds not euros! And a quarter, as in 3 months. I don’t remember the other numbers, but they were all impressive. I know he had all his numbers where many of us had blank spaces for certain figures that we should have known.

My first thought, after the initial shock, was why is Jeff in this room? He is making a fortune and runs a very successful practice so what help would he need. We had a break at half 11 and I caught up with Ger. All we could talk about was Jeff. We immediately christened him Saint Jeff. Then we questioned if Jeff was real. Was he an actor or a plant by Rudi? If we worked with Rudi for the next 5 years and gave him lots of money, we could be like Jeff too. Imaginations running wild. As the day went on, we found out more and the cult of Jeff grew further.

Lessons Learned

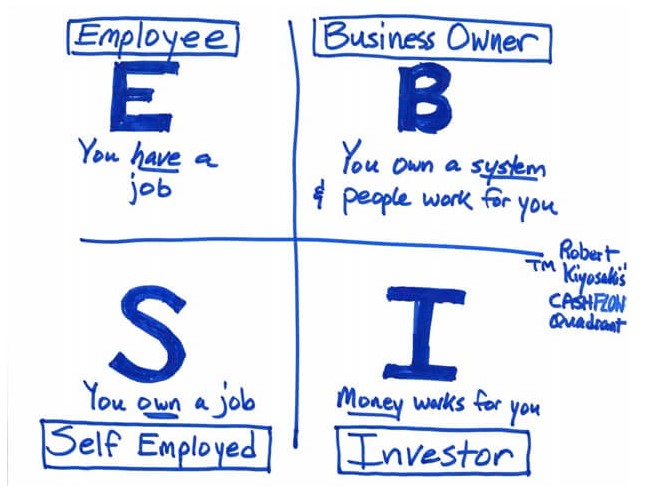

We were both stunned, thrown, but curious too, wanting to find out more about Jeff and why was he here. Rudi then introduced us to the Cashflow Quadrant of Robert Kiyosaki – see here

As you will see on the left side of the quadrant are employees [E] and self-employed [S]. There isn’t a lot of difference between the two. For an employee to earn more money they get more education and skills and look for a higher paying job. While a self-employed person trades their time for fees so to get more money they work harder. Per Kiyosaki, they don’t own a business but own a job. While we had a couple of employees at the time we were still very much in the self-employed category.

On the right-hand side of the quadrant are business owners [B] and investors [I]. The business owner has a system or product that makes money even when they are not working. They develop systems and hire great people, so the business works super well when they are not there. An investor uses the money from their business to invest in other assets that give them income. They may not work at all and use other people’s money to generate wealth and income.

Everyone in the room with Rudi was on a business journey. We were looking to improve and were investing our money to get the help to do it. We were looking to move from self-employed to business owners. And Jeff had a purpose too. He was already in the B category but wanted to move to being an Investor. He had already done that in a small way. Sharon was a lady from London who ran a successful bookkeeping company. She was aloof and quirky so wasn’t giving away much at first. Her numbers were impressive too. It turned out that she worked for Jeff before, and he helped set up her bookkeeping company. Plus, he was a 50% shareholder. Saint Jeff does it again.

What we don’t know

Going into that room in East Midlands was a complete eye opener for us. Not only because of Jeff but also realising that we were in the same boat as many of the other businesses. Issues around sales, getting paid, marketing, getting the right staff, and others. Getting to be like Jeff was the goal. That’s why we were in awe of him as he had achieved what we would hope to achieve. It also gave us great hope that someone could be so successful. And he wasn’t happy where he was either. He wanted to get more into the investor quadrant. He wanted to extract himself from the business and know that it would run even better without him.

We didn’t realise how important the numbers were and all the elements that went into the numbers. After all, sales produce the numbers and had we a system of winning new business to increase sales? And if we won new business who would do all this extra work? Had we the right people? And if we increased our sales, how would we collect the money sooner so cashflow was strong? Even though we were in business for 4 years our business journey only started the day we walked into that room.

The issues in our business are the same issues all business owners have. People, systems, payments, sales, marketing and so on. It is challenging but it is interesting too. For all the times you are tearing your hair there can be huge positives. The small wins and larger wins for us and clients give us the drive to keep improving. For me, it starts with having the right people and from there getting the systems in place. Knowing your numbers is vital. Jeff knew his, while the rest of us only had some. How do you know if you are going in the right direction? By examining your numbers regularly and challenging them. Making decisions based on up-to-date numbers. First, though why do you want to improve your business? A great place to start is to start with the why.

Want to have confidence in your numbers and get the information you need? Call Deirdre on 051396703 or start Here