A new non-resident landlord withholding tax system or NLWT as Revenue call it. I know this is not the most thrilling news you’ll hear today, but it’s important if you are in this space. We have non-resident clients who we do this work for. The purpose of the blog is to give you an idea of how the new system works. And why there’s a new system. We’ll introduce you to Bob Cratchett to show you how it works. So, let’s go through

- Out with the old

- In with the new

- How it works for Bob

- Other issues

- Summary

Out with the old

It’s a case of out with the old system because it didn’t work too well for Revenue and the collection agent. Typically, a letting agent would collect the rent and deduct the 20% withholding tax. After the end of the tax year, they’d pay the taxes deducted to Revenue and issue a Form R185 to the landlord. For 2022 it would look something like this

| Name of Payer | Tom Brady |

| Name of Payee | Bob Cratchett |

| Tax Year | 2022 |

| Gross Rent | €12,000 |

| Taxes deducted | €2,400 |

| Net paid to landlord | €9,600 |

The collection agent pays the money to Revenue in June 2023. A couple of issues here. The landlord can’t file the 2022 tax return until the tax withheld goes to Revenue. Revenue themselves, don’t get the tax until halfway through the next tax year. Plus, the main problem rests on the shoulders of the collection agent. The agent, and not the landlord, is the person responsible for filing the tax return.

So, if the landlord didn’t bother sorting out their Irish tax return, Revenue would go after the collection agent. This placed a heavy burden on collection agents who are not tax advisors. As you can understand many letting/estate agents wouldn’t want that responsibility. Their job is to look after the property and collect the agreed rent from the tenant. And not file a tax return for the landlord.

In with the new

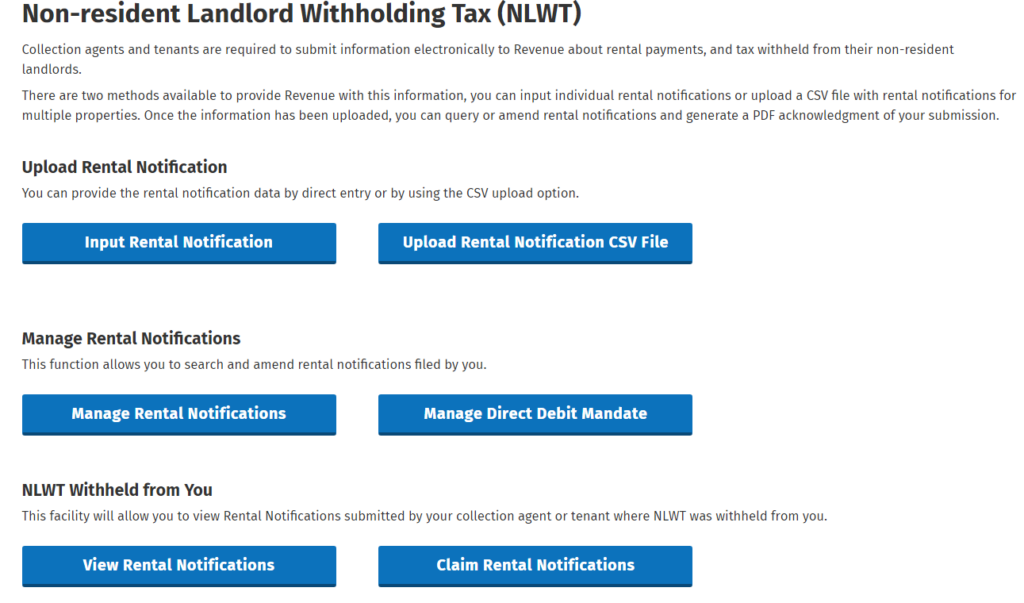

It was in with the new from the 1st of July 2023. The new NLWT system is slick and works well, certainly from a Revenue point of view. They get the tax straight away. Plus, if the collection agent operates the new system, Revenue will go after the landlord. Not the collection agent. The paper is gone and replaced with a notification and payment system on ROS.

Revenue want the tax “forthwith” which they say is 7 days after the payment and deduction takes place. They give an example of a tenant paying within 7 days. For collection agents, they state the payment should be on the 1st of the month following the date they collect the rent. As you’ll see with Bob, Revenue will have your money and it’s up to you to file your tax return to get any overpayment back.

How it works for Bob

We’ll show you how it works for Bob. Bob Cratchett lives in a Pilates commune in Slovakia. He does some Hatha Yoga in the morning and some sports Pilates in the afternoon after a healthy lunch of leaves and berries. All washed down with dandelion tea. You can almost hear “no woman no cry” from Bob Marley playing in the background! Bob Cratchett, not Marley, has 3 properties in Ireland

- 5 Tom’s Place, Tramore. Residential Property. Rent is €1,200 per month

- 15 Grove Avenue, Mary’s Park, Clonmel. Residential Property is €1,000 per month

- Unit 3 Concorde Road, Navan Business Park. Commercial Property. Rent is €2,460 including VAT. €2,000 net of VAT

Property ID

Bob must have a property ID for each property so we, as his collection agent, can make a notification to Revenue. Each of the residential properties will have a Local Property Tax ID. But the commercial or agricultural property, such as land, won’t. In this case, Bob needs to generate an ID and provide this to us. It’s straightforward to do this by entering the address and Eircode on the NLWT system. You’ll see an example of how to do this in the Revenue guidance.

Rental notification

The ‘Input Rental Notification’ section is on the NLWT section of ROS. Bob confirms that he received the following rent in January 2024

| 5 Toms Place | €1,200 | 04/01/2024 |

| 15 Grove Avenue | €1,000 | 07/01/2024 |

| Unit 3 Concorde Rd | €2,000 plus VAT | 10/01/2024 |

We make a rental notification for Bob on the 1st of February 2024. The information we need to make the notification for him is

- Tax Type of Landlord – Income Tax/Corporation Tax or VAT

- Landlord PPS number

- Name of landlord

- Address of landlord

- Property LPT ID

- Property address

- Rental payment date

- Payment Gross [exclude VAT]

- Tax calculated

We have to make a separate notification for each property. The commercial property notification would look like this

| I am making this RN as a | Collection Agent |

| Landlord name | Bob Cratchett |

| Landlord Tax type | Income Tax |

| PPS number | 1234567B |

| Address | 1 The Commune, Bratislava, Slovakia |

| Property LPT ID | NL0000452 |

| Property address | Unit 3 Concorde Road, Navan |

| Rental payment date | 10/01/2024 |

| Gross Payment amount | €2,000 |

| Tax withheld | €400 |

When making the rental notifications, we submit the tax payments to Revenue. Gross rents come to €4200 so Bob owes €840, and we process the payment using Bob’s Irish current account.

January 2025

Let’s roll forward to January 2025 and assume the rents were the same for each month of 2024. We made 36 rental notifications for Bob on gross rents of €50,400 and he paid tax of €10,080. We then prepare Bob’s rental computations and prepare his tax return. His combined rental computation looks like this. Remember you must do a separate rental computation for each property.

The following figures are on Bob’s Income Tax return for 2024.

Gross value of Rental Income subject to NLWT for 2023

Gross value of Rental Income deductions for 2023

| Rental Income | €50,400 |

| Less Expenses | |

| Insurance | €1,200 |

| Accountancy Fees | €1,500 |

| Repairs | €3,600 |

| Mortgage Interest | €5,900 |

| Utilities | €600 |

| Rental Profit | €37,600 |

Bob’s Tax Liability

Bob’s Tax liability on a profit of €37,600 is as follows

| Rental Profit €37,600 x 20% | €7,520 |

| Less Personal credit | €1,875 |

| Net Tax liability | €5,645 |

| Add USC | €809 |

| Total Tax liability | €6,454 |

| Less NLWT deducted | €10,080 |

| Tax refund due | €3,626 |

So, Bob is due a refund of €3,626. The only way Bob can get the refund back is by filing a tax return. He can’t get Revenue to refund the tax to him during the year. Nor can he offset it against some other tax like VAT. If he doesn’t file a tax return, then Revenue hold onto the full €10080 NLWT deducted.

You’ll see he got a personal tax credit of €1,875 for 2024. This is because Bob’s only income is his Irish income. If he had foreign income, then he’d get some personal tax credit. The Pilates work doesn’t pay although his six-pack is serious. Unlike the writer who has an amazing 12-pack!

Preliminary Tax 2024

Bob doesn’t need to make a preliminary tax payment for 2024. Each NLWT payment is a payment on account that goes towards his 2024 tax liability. Bob’s preliminary tax liability for 2024 should be reduced by the amount of NLWT deducted. Even Revenue admit that NLWT deducted will more than cover the Tax liability in most cases.

“So for some (even many) non-resident landlords, NLWT will reduce their preliminary tax liability to zero.

Other Issues

As a first step to get onto the non-resident landlord withholding tax system the landlord must register for Income Tax. If a company owns the property, then the company must register for corporation tax.

Repeat Rental Notification

It’s possible to set up a repeat rental notification provided you do the first one in the normal way. This could be useful if a tenant was doing this and knew that the rental payment would be the same for a year. It would set up a monthly rental notification and payment to Revenue on a set date each month.

We don’t set up repeat rental notifications for clients in case the rent changes. Typically, rents tend to go up or there could be no rent if a tenant leaves or the landlord sells the property.

Property owned jointly

For property owned jointly a rental notification is needed for each landlord. If Bob was married to Mary and they owned 5 Tom’s Place jointly then they’d each make a monthly notification for €600. And each would pay €120 NLWT on their part of the rent.

Mistakes

It’s possible to correct and amend any incorrect notifications on the NLWT system. You have until the end of February of the following tax year. After that date, you’ll need to contact Revenue through My Enquiries.

Summary

In summary, the new NLWT system is quite impressive. It’s a super win for Revenue as they are getting the tax in very quickly. Plus, they are getting all the landlord information. This can only increase compliance levels. It’s a winner for the estate agents and collection agents too, once they engage with the new system. They can choose not to but then Revenue can have them in their sights.

We are happy to provide a collection agent role for clients but only if we make the rental notifications. We won’t file tax returns for clients unless they are using the NLWT system. Some estate agents will make the rental notifications for clients while others won’t. Those that don’t could find themselves losing business to those that do.

If you need help to stay on top of your non-resident returns, Start here

Pingback: Collection Agent Service - Comerford Foley