What happens in our first meeting, and why we charge for it

When you come to an accountant, you’re looking for support to solve a problem. It might be that you need some tasks taken off your hands so you’re not feeling constantly exhausted. Or it could be that you have something really complex going on in your business and you want to discuss it with an expert.

Either way, you want:

- A real conversation about the specifics of your business, personal situation or problem

- To know you’re getting truly helpful advice from someone who understands business

You can feel confident you’re getting both when you book a meeting with us.

How a meeting works

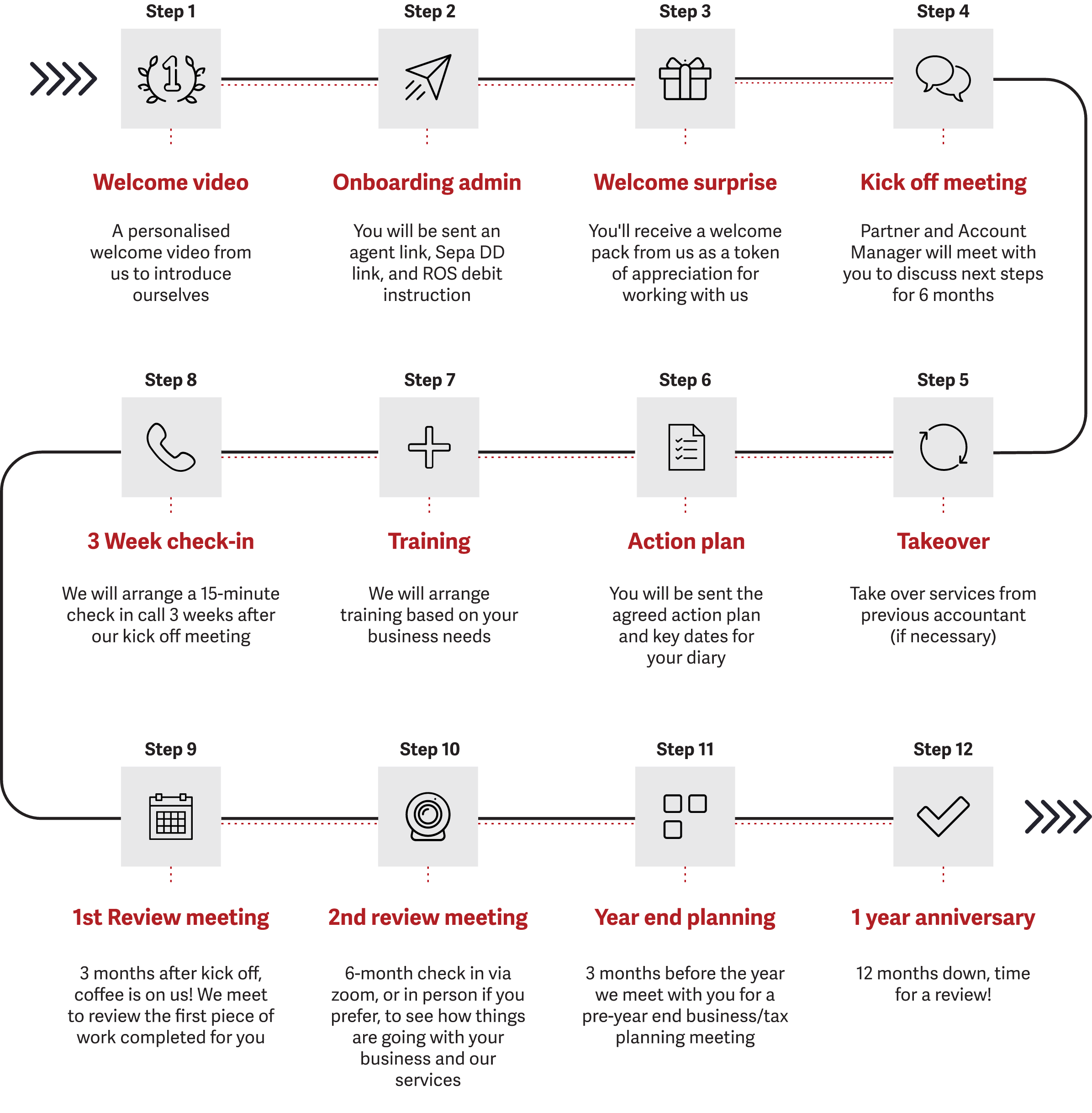

What comes after

Why we charge for the meeting

If you call into your dentist with a toothache and they don’t charge you, you’d think they’d gone off their rocker. If the solution was so cheap, you’d be worried they hadn’t done enough to solve the problem long term.

In the same way, we ask you to make a small investment in the first session with us, so you get to spend time with a specialist and walk away with valuable advice. Going through the process (in person or virtually) will leave you feeling confident in your next steps, and your investment in our time means we don’t need to hold anything back.

For more detail on why we charge for our first meeting read our blog here.

What do we charge?

The cost of the meeting will be between €75 to €125 plus Vat. It’s not a one-size-fits-all cost because it depends on the nature and complexity of the issue you have. For more complex issues you may need a more senior member of staff to advise you.

We always try and offset our costs where possible so that you can get a tax write off for our fees. If you are in business and Vat registered and paying tax at the higher rate our €125 plus Vat cost will cost you about €60.

Feel confident you’re getting the best advice from day one

Make a small investment to speak to a specialist so you’re not paying more in time and money down the line.

To understand more about how we work, download our manifesto

Download manifesto