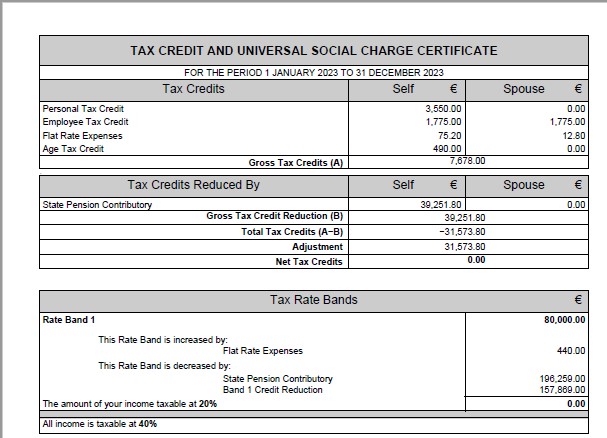

Like the Bob Dylan song, in the world of Non-Resident Taxes, the times are a-changin’. Not before time too as there was a lot wrong with the old system. But there’s no point looking into the past. It’s time to drive on and embrace the new. We will look at George and Amy Wong Non-Resident

That nagging 'what if' about your finances? It's costing you growth.