There are Retirement Relief changes in 2025. From 1 January 2025, Revenue will introduce some new rules. Why 2025 and not 2024? The thinking is that it allows business owners to benefit from the old rules. Some planning opportunities in 2024 before the changes in 2025 kick in. You’ll see what I mean below, at

Category Archives: Selling My Business

This week we’ll have a look at business exit planning. What are the things you should be discussing with your advisor? And what would you like to achieve? The main talking points will be Meet Maeve O’Leary How do I value my business Tax efficiency Future options Maeve O’Leary Maeve O’Leary, or Mol to her

Is your company shareholding right is the question that is tumbling around in my head. What sparked the idea for this blog was a meeting with a businesswoman on Wednesday. She wanted a chat about growing and valuing her business. Ultimately, she’d love to sell it and we got onto the topic of who owns

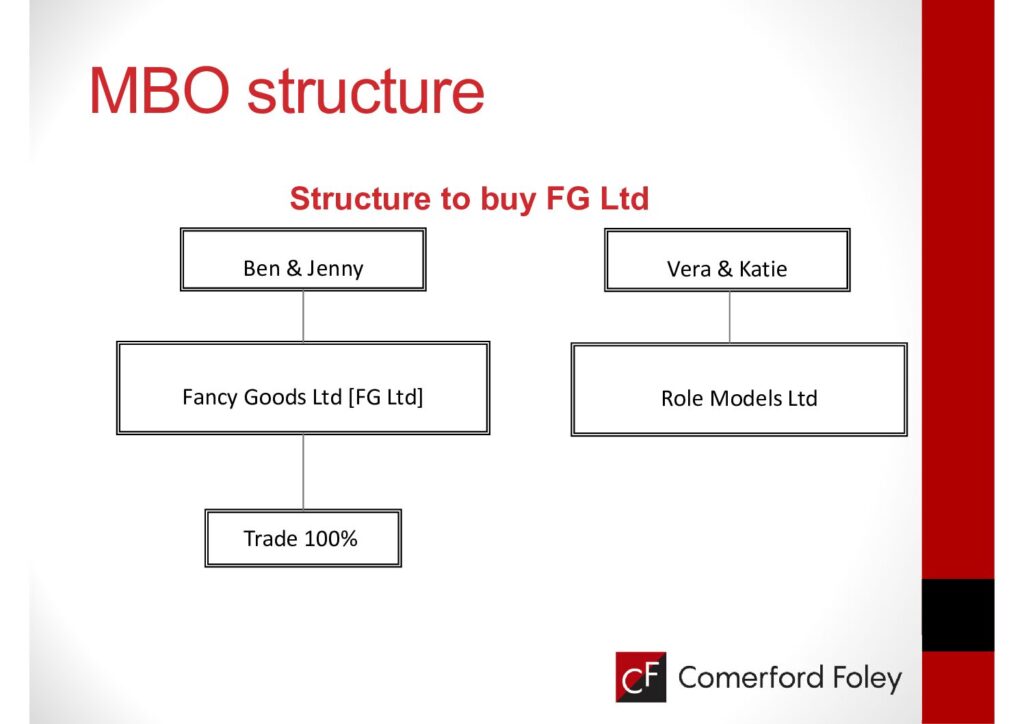

When you sell your business is a Management Buy Out an option? We look back at an MBO success story that we were privileged to be involved in. Ben and Jenny Fox own Fancy Goods Ltd which sells luxury products to wealthy individuals. They have a shop and a growing online presence. Vera and Katie

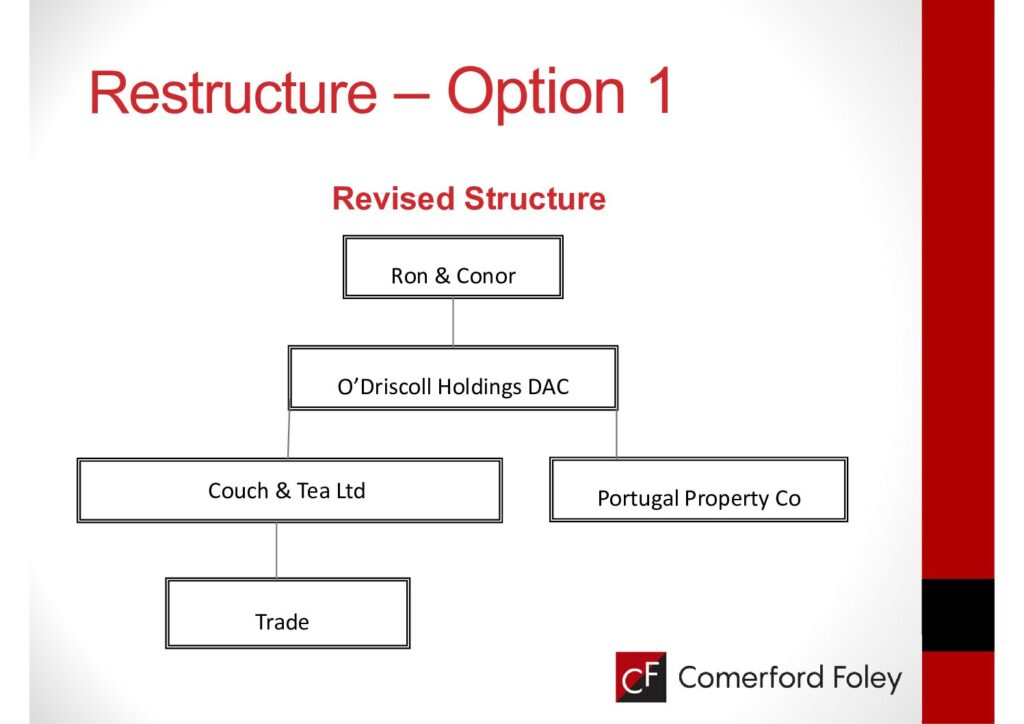

We will look at a holding company structure and see how this works. You’ll get to know the O’Driscolls and their reasons for setting up a holding company. The main points that we will look at are Introduction How it works Advantages Disadvantages Summary Introduction Ron and Conor O’Driscoll [Rod & Cod] are brothers, in

We will look at some tax tips when you sell or rent land. For this, a sale will be to a third party. Land sales are like hen’s teeth. Very rare. It is more common to transfer to the next generation. In the current climate land is achieving a high price on a sale or

When selling your business, you want to maximise the value and pay the least amount of tax. But know you have covered all the bases. We will look at an asset sale and a share sale. Plus give you some Tax Tips that can help get things straight in your head. The focus will be

We will take a closer look at Retirement Relief and give you 5 Tips that can help you plan. “When I get older losing my hair Many years from now Will you still be sending me a Valentine Birthday greetings bottle of wine If I’d been out till quarter to three Would you lock the

We will discuss a recent case that involved Retirement Relief and farming. This case is not only relevant to farmers but to business owners too. It came up on my news feed last night and piqued my interest. How much tax was in play? What were the circumstances and who won? I got stuck into

Cash in Your Company – What to do with it? Have you cash in your company? Do you know what to do with it? What do the directors do with it and how do they make it work for them? The main points we will focus on are Salary/Dividends Benefits Pension Invest Cash extraction