Tax returns for company directors need an extra touch of love and affection. To use a Top Gun analogy, multiple bogeys are heading in your direction. I’ll look at some of these bogeys and other quirks for company directors’ Income Tax returns. By company directors, I am talking about owner directors who own 15% or

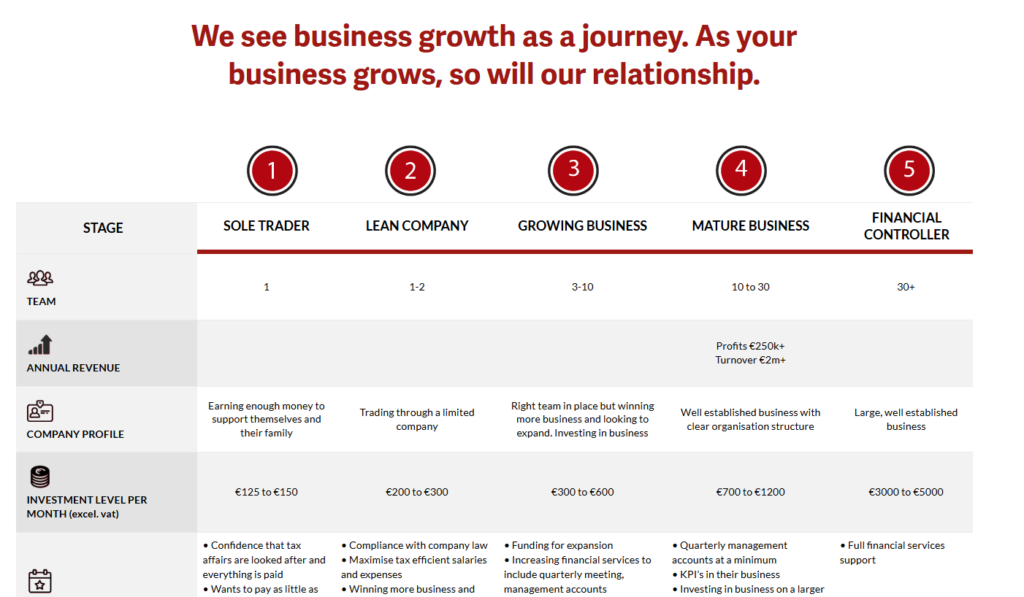

That nagging 'what if' about your finances? It's costing you growth.