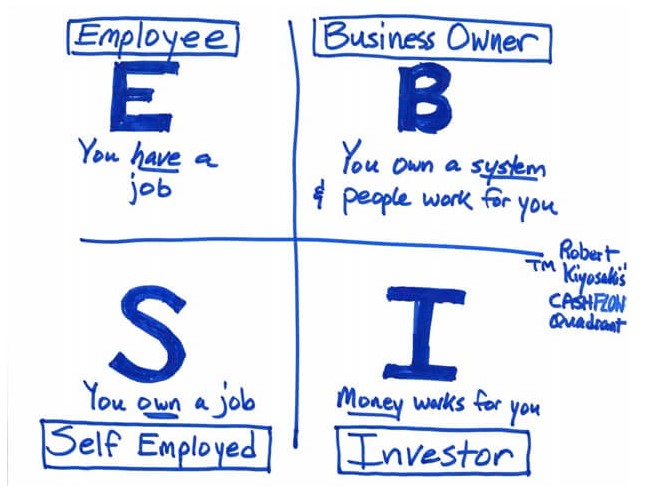

Last week we spoke about Our hero Jeff when we first started working with an accountancy coach in the UK. We learned about the business journey and Jeff’s numbers. See here This week we will talk about a meeting I had with Judy who was looking to discuss business formation. We will look at Judy’s

That nagging 'what if' about your finances? It's costing you growth.