A catchy title. Bookkeeping – Outsource or Die is the title of a book. We were working with a business coach for accountants in the UK and the guest speaker Mark wrote it. He was a UK national living in the Philippines. He and his team provided outsourcing solutions to UK accountants. Successful and smart, the talk from him was interesting but, to be honest, I never got around to reading the book.

It begs the question. Would your business really die if you don’t outsource? Most likely not. But would it be better for you and your business to outsource? Very likely, yes. Let’s take a look at why.

- You hate doing it

- Your skills are better elsewhere

- Fear of letting go

- Want to be looked after

- Summary

You hate doing it

And I mean HATE. Capitals all the way, just to emphasize how much you hate doing it. It’s not your thing. You’d rather eat a plate of liver with a side of celery and wash that down with a nice glass of cod liver oil. Like the cod liver oil, you know it’s good for you but it’s disgusting. So, what do you do? Put it off. I’ll do that tonight. No, I’ll do it at the weekend or next week when Storm Betty arrives to pummel Mayo and work its way down to us.

Despite the trauma you know you have to do it. The lads need payslips. I’m due a VAT refund and Revenue won’t give me back the money until I get the return in. Three suppliers are screaming for payment or else they won’t give me any more materials. That fella owes me a fortune, but I didn’t send him the invoice yet. Like the Blink-182 song. All the Small Things.

Ask yourself why you hate doing it. The answer, in most cases, is that you are not very good at it. Not confident doing it and you have enough going on in the business without the paperwork on top of it. Words like “Postponed Accounting for VAT” and “Reverse Charge” give you the shivers. Imagine you are sitting down at night, and you say to the Mrs.

“Hey Bridget tell me again how we include that Intra-EU acquisition on the Vat return of trading details”?

There’s no greater passion killer than VAT.

Your skills are better elsewhere.

Your skills are better elsewhere. Is that true or false? Only you can answer that question. Think of Liam Neeson in Taken and one of his famous lines

“….but what I do have are a very particular set of skills, skills I have acquired over a very long career…..”

You have skills that make you money, grow your business, and enhance your reputation. We have skills that do the same for us. Also, Revenue have a particular set of skills

“…skills that make me a nightmare for people like you…”

Pharmacists, Estate agents, Carpenters, Doctors, and Dentists, I can’t do your job. But you can do mine. Or can you? If I had to put in a filling, I’d be looking for blue tack to put in the cavity. That wouldn’t work. And then I’d need the help of three professionals to fix the problem. I could have saved the trip to the doctor and the pharmacist if I’d gone to the dentist first. Think of that extra cost. Time and money wasted by not going to the right person in the first place.

Everyone is working hard out there. Most people are making very good money but earning it, with graft and skill doing what they are good at. And in most cases, you enjoy doing what you are good at. You are confident doing it, helping people who need your services or products. You make your customer’s lives better. Many like you have too much work but you do it because your customers need you and you have bills to pay and mouths to feed. There’s a pride and value in that work.

Do you want to do the paperwork too? Some do and that’s fair because they want to maintain control. For many, there’s a fear.

Fear of letting go

We’ll call it FOLG, like fog with an L. Fear of letting go or losing control of your finances. Would that happen if you outsourced your numbers?

We have a good client Tom who has a building company, MC Hammer Ltd. He and his business partner work very hard as they travel a lot to go where the money is. He’s very conscious of having supplier statements to hand, so he knows the cost of the materials used. That’s vital for his company as they pass on those costs to the client. Not only that but having access to all the paperwork gives him an understanding and overview of the business. He doesn’t want to give that up. Classic FOLG syndrome.

Brenda, an excellent member of the team here, picked up a few errors with Tom’s bookkeeping. Two errors that he was unaware of until Brenda pointed them out. Costly.

| Incorrect Reverse Charge – Vat | €20,500 |

| Wrong PRSI Class for Directors | €4,500 |

| Total | €25,000 |

Thankfully this money isn’t lost, and we’ll help get it back. But if she hadn’t picked this up, then the same mistake could happen year after year and the cash drain continues.

Control

Would Tom lose control if he hands the bookkeeping over to us? No. He’d have more control and a better oversight of the business. A complete view of the business from his mobile phone or laptop. He can look up all his invoices in Dext. See invoices per supplier from the newest to the oldest. Look up his sales invoices in Xero and see who owes the company money and how long they owe it for. Plus, see what’s in the bank and what money the business owes to suppliers.

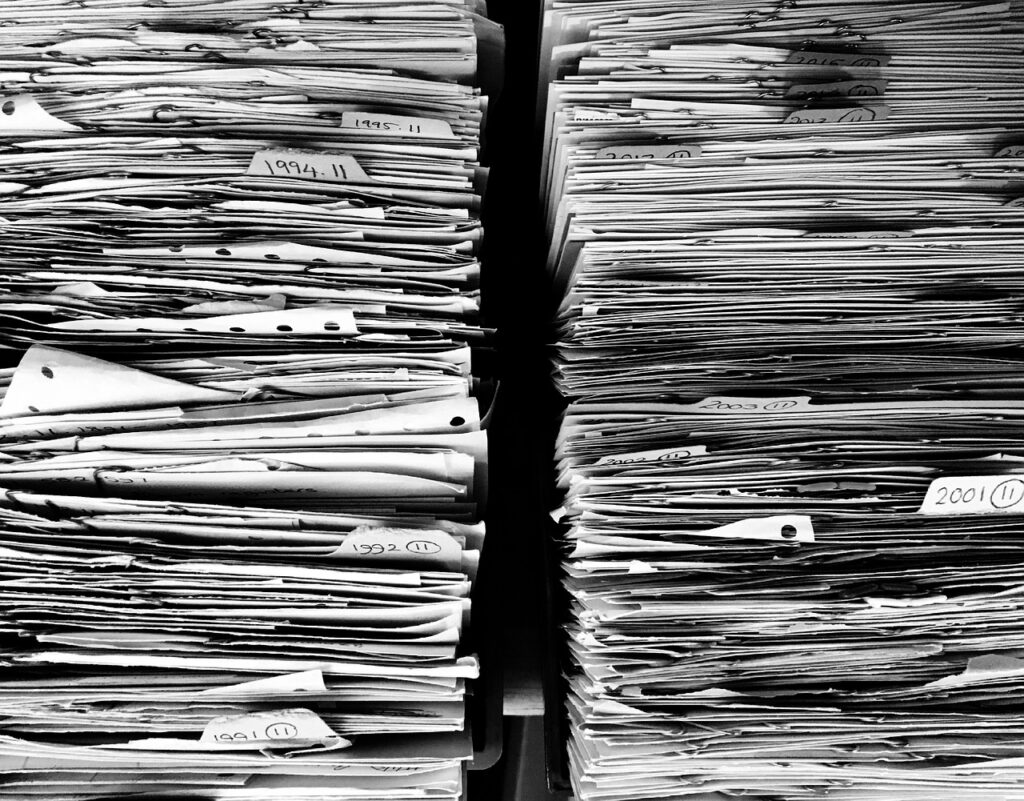

The lever arch folder of invoices and bank statements is no longer. The info is on his phone to check when he needs to. Not when he gets home in the evening. The big step for many business owners is trust. Do I trust these people to look after my numbers the way I do? And do they have the skill to do that and, if so, what’s the cost for me? All valid questions.

Want to be looked after

Want to be looked after = Protected. One of our best clients is a pharmacy business. The owner is not into management accounts, budgets, or projections. He just wants to be looked after. But what does that mean? To us, it means that

- Everything is right. As in VAT, Payroll, Accounts, Co-sec and Corporation Tax

- Suppliers get paid on time

- Employees get the right payslips and paid on time too. And their holiday and public holiday pay is right.

- All Revenue returns get filed on time

- Tax clearance is a must

- He can call us when there’s an issue and we want to fix any problems that arise for him. As in we care.

- Knows there won’t be a problem if Revenue come calling

He’s not a guy that calls us often. But when he does, he knows that we’ll be responsive and try and fix or explain any issues that crop up. So many business owners are like that. They have great businesses, and they don’t want the hassle of dealing with payroll, VAT and RCT. They are making good money with plenty of cash in the bank and want that protection. Call it a security blanket. Knowing that everything is looked after.

Protection

Michael who’s a director is a great local company said to me recently.

“Listen. A lot of what you just said to me went over my head. I work hard here, and we have a good business. I don’t know this stuff. When I get older, I don’t want anything coming back to bite me. That’s what I am paying you for”.

That need for protection comes from a genuine fear of Revenue. The fewer dealings with Revenue the better. Brown envelopes with harps make people shudder. Guilty as charged your honour. Lock me up. Thoughts that we have even when entirely innocent. Life is stressful enough without Revenue knocking on my door.

“If you file your VAT return on time I will not look for you. I will not pursue you. But if you don’t, I will look for you, I will find you, and I will kill you.”

Trust

It comes back to that word. Do I trust these guys to look after my numbers? Will they be there for me when I need them? I could start telling you that we are brilliant at this and at that. But as the saying goes, self-praise is no praise.

We did a case study with our clients Conor and Amy from CLS, in Carlow, and asked them why they decided to work with us. Some of their reasons were

“Young and approachable and got on well”

“Embracing technology including Xero”

“You had an in-house tax person”

“We didn’t want to go to a larger firm because we didn’t think we’d get the personal service we get from Comerford Foley”

Summary

We see good bookkeeping as an investment in your business. It provides a solid foundation. As in the numbers are right. Staff and suppliers are taken care of. Getting the basics right is the stepping stone to good finances and it’s vital to look after the numbers. Do you really want to or need to be doing this stuff? Outsourcing to the right business partner can only be a positive for your business.

But a word of warning. It’s not magic, as in a flick of a button and everything is brilliant. There is a journey to go on to invest in a quality bookkeeping process. You must be willing to go through some pain [time and effort] to get there. But when you do, you’ll realise that it was a super business decision to make.

We want to work with clients who see the value in getting the numbers right. Rather than you doing it, you gain a team that can help you and your business in so many ways. A partner in your business. You won’t die but you’ll live more.

Want to be looked after to make sure everything is right? If so, Start here