Black Friday Vouchers!

If you haven’t heard today is Black Friday so it seems pointless to be at work when we should be shopping for bargains. And Monday is Cyber Monday so more shopping required but the on-line version! As I was listening to the radio early this morning one of the djs work colleagues had done her black Friday shop on-line but forgot to enter the discount code, so no bargains were had.

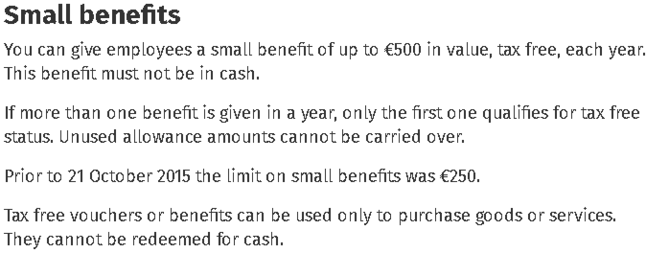

My business partner pointed out that today would be a good day to do a brief blog on vouchers. Employers can give a one off voucher, per calendar year, up to the value of €500 and the employee doesn’t have to pay PAYE, PRSI or USC on it so it’s completely tax free in the hands of the employee and the employer doesn’t have to pay employer’s PRSI. So you get the full amount.

As stated only one voucher up to the €500 value will work. If an employer gave an employee two vouchers for €250 each, the first voucher would be tax free and the second voucher would be liable to all the taxes. Also if the voucher was for €600 then the full amount would be liable to all the taxes. It’s not a case that the first €500 is tax free. In that scenario you could give 2 vouchers with the first being for €500 which is tax free and the second voucher for €100 would be liable to tax as normal.

Company directors can give a voucher to themselves up to the value and they can even give a voucher to their spouse provided the spouse is a director or employee. It is not a requirement that the directors have to be on the payroll.

Vouchers have to be in non-cash form and not redeemable for cash.

As proof that the voucher benefit is true and can result in a mini windfall for directors and employees I have even gone to the trouble of copying a brief note from the Revenue website.

I hope An Post have enough staff to cope with the throngs!

For the latest news and advice check out our resources page!