That nagging 'what if' about your finances? It's costing you growth.

Company Formation

See how creating a limited company has given businesses like yours a better chance to succeed and grow.

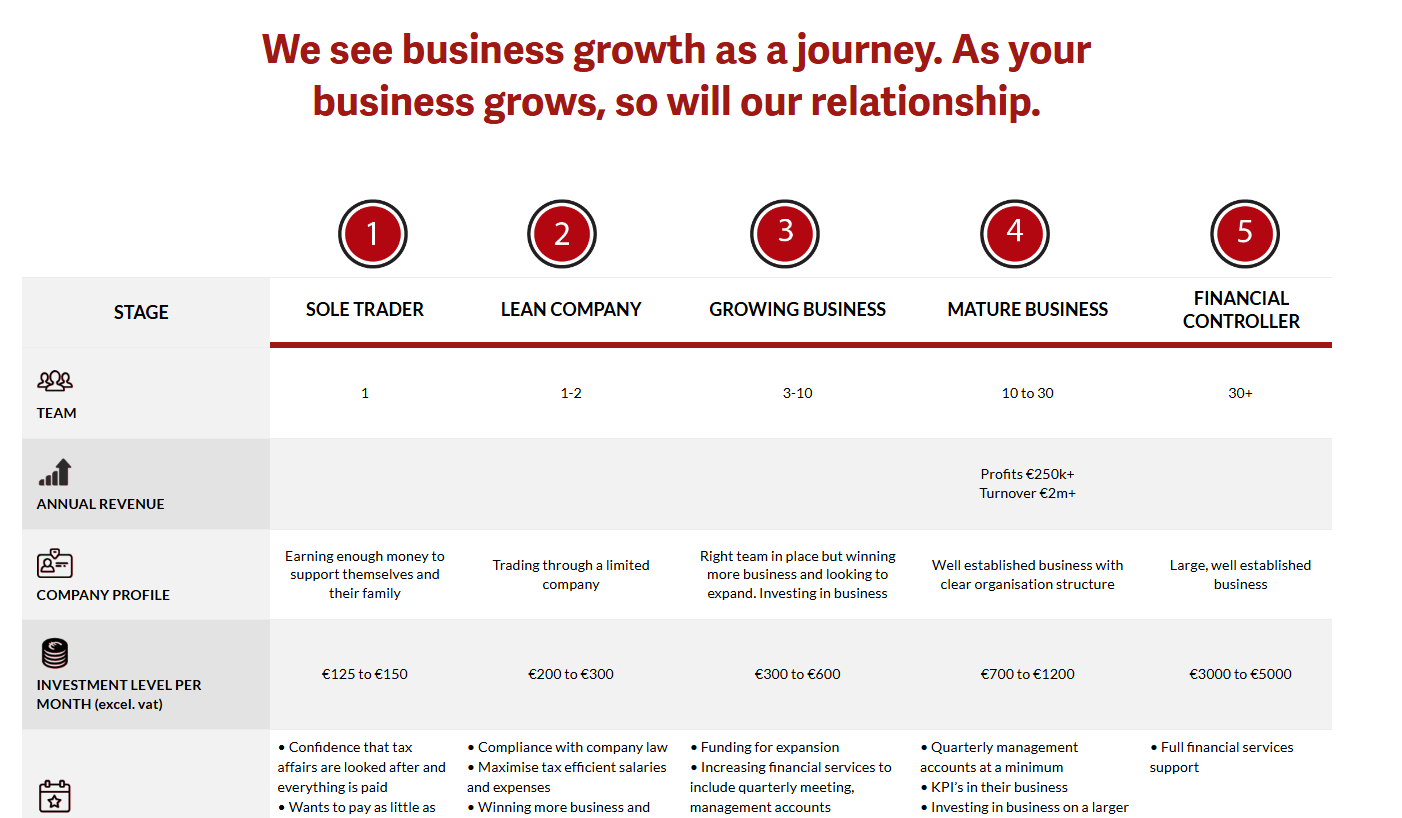

Advice on taking business to the next level if you are:

When we start out in business, most of us are just happy to be making sales doing what we love.

You may have made it this far mixing the business with the personal under one roof – income, funding, tax, bills – and that’s fine.

But you’re here because you’re thinking about your future.

“.

“We have been working with Comerford Foley for 3 years now and have always had a great service from the guys there. As a start-up SME, we require a lot of support in managing our financial back-office requirements and processes and Comerford Foley have been fantastic.”

– Peter Healy, HKL Holdings Ltd

One of the major reasons business owners transfer from Sole Trader to Limited Company is to establish their business as a separate entity. This means your personal assets are protected from any business debts or issues.

But there are more advantages.

One of the major reasons business owners transfer from Sole Trader to Limited Company is to establish their business as a separate entity. This means your personal assets are protected from any business debts or issues.

But there are more advantages.

Consider the transfer if you want to:

Advice on taking business to the next level if you are:

- You will have duties as a Director – and you’ll need to be aware of the rules under company law.

- It can be more expensive – You will have more reporting requirements as an established limited company.

- Less privacy – The balance sheet of your company accounts is filed with the Companies Registration Office.

- Money is not your money – this protects your personal assets, but does mean that it belongs to the company that you own, not to you personally.

- It’s not the best choice for property or investment assets – In most cases. You’ll want to have a chat with us about your best options if you fall in this category.

Let’s make it a painless transition

How we can help

“Comerford Foley provide us with the services we need to ensure all our numbers are up to date, that we are compliant and can focus on our business growth. By ensuring our bookkeeping and reporting is up to date we have up to date financial information that we can rely on in making our business decisions for the future.”

– Seagull Bakery

If forming a limited company is the best choice for you, we want to make it as easy as possible to get it sorted. We don’t want you to miss out on opportunities because you don’t have time to figure it all out.

Some questions you may have in our initial consultation:

- What will my obligations be as a company director?

- How do I give someone a share in my business?

- What services do I need trading as a company?

- What shareholding should I have in my company?