It’s all about the numbers!

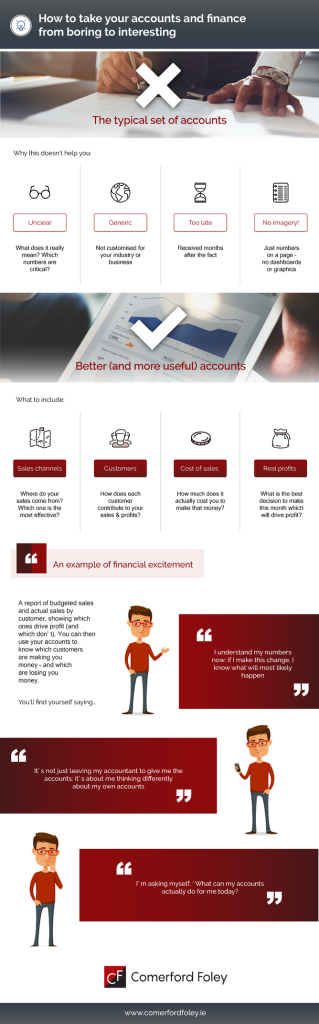

While you could spend hours and several pages trying to explain what business is about, in essence it comes down to profits. The only way of knowing the profitability of your business at any stage is to have a real understanding of the numbers. As one of our more entrepreneurial clients will always say to me…..”it’s all about the numbers”……and they are right.

So how do you get to this position of total comfort with your business numbers and profitability? This will be a position where you can worry less and focus on the future for your business which in turn impacts your family and employees.

Do you have to work daily with your Accountant, have an in-house finance team and invest heavily in IT and resources? While all of this would obviously help, it is certainly not necessary. With some quality hours of input from your Accountant to assist in designing processes and procedures to capture key information, you can be in a position to have a reasonable handle on your business weekly profit and loss account with relative ease.

You may ask yourself, so how would this help me grow my business. Your thought process may be…..I have a business to run, I don’t have time for numbers….that’s what the year-end is for! Well this attitude is costing you money for sure. Imagine a scenario where you knew which customers make you money as opposed to those that lose you money, which products earn the higher margins, which products have better run rates at certain times of the year? And not only that, but you had this data on a weekly basis?

Profit & Loss Account

The business profit and loss account is essentially Sales less all expenses. Expanding this further it is Sales minus Cost of sales to arrive at Gross Profit and then minus Overheads to arrive at Net Profit.

The How?

So how do I get this information weekly? If you are like most SME businesses you probably box up the books and record’s three months after the year end, send them to your Accountant, bless yourself and hope there is a profit…..but no tax to pay! If this is the scenario it should still be possible to have a fair idea of the final profit or loss figure that your Accountant is going to tell you before the Accounts are produced.

The steps involved are as follows:

- You need to develop a process to identify your sales on a weekly basis. This is probably straight forward. In a retail scenario the till system or EPOS will generate a report. In a consumer goods or manufacturing business you simple need to be able to run a report of sales invoices or despatches by product for the week

- Next is the tricky part and this will take some initial input and discussion with your Accountant. You need to establish what the cost of those goods sold at step 1 was. This is what it cost you to either buy-in and get ready for sale or to manufacture yourself from raw materials. Included in this is the product cost, the labour to manufacture, the packaging, the cost of transporting raw materials into your warehouse etc. In a retail situation, by running through the sales report by product you will be able to assign the costs of buying in the products to arrive at this number. In a manufacturing business you could design a simple standard costing template in excel where you have a reasonable idea of what it costs you to manufacture each product type. A couple of hours with your Accountant will have something in place.

- Finally you need to establish the overheads for the week. These are all the costs to run the business which cannot be directly attributed to manufacturing the product. e.g. administration salaries, rental, rates, professional fees etc. If you have a good budgeting process at the start of the year you could simply establish a best estimate of what these costs will be for 12 months and divide by 52 to get the weekly overhead run rate.

By putting in place a process to capture the data at the above 3 steps you will have a good handle on the profitability of your business for each week. Armed with this information you can make decisions around which customers to serve, which products to push and whether or not you can afford promotional discounts on certain product lines or not. You can also make those difficult but crucial decisions about cutting certain products or customers (yes you heard me…..some customers are just not profitable for whatever reason and not a good fit for your business!). The information will help you develop your overall growth strategy and ensure this strategy is implemented with a profitable business model.

We have helped a number of clients develop this type of process to allow them capture this information and would be delighted to meet over coffee to discuss ways that we can help you achieve your business goals!

For more tips and advice check out our resources page.