My Business Loans have been Sold – What happens Now! The sale of business loans is a very real issue facing businesses in Ireland today. A legacy of the financial crash, it is important that if you are impacted by such a sale you understand what this means and the options open to you. The

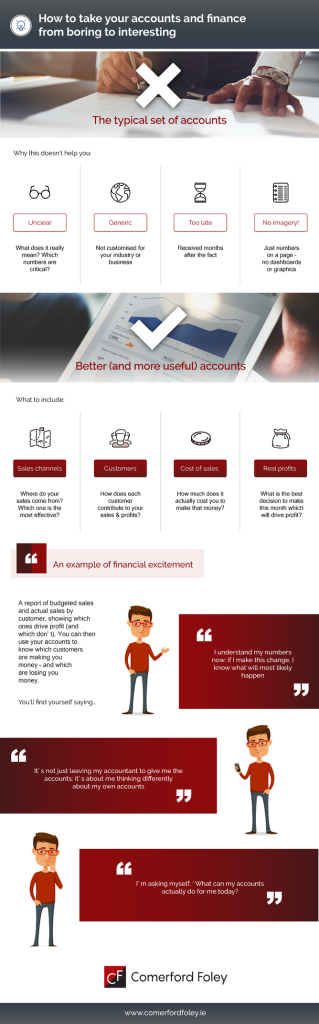

That nagging 'what if' about your finances? It's costing you growth.