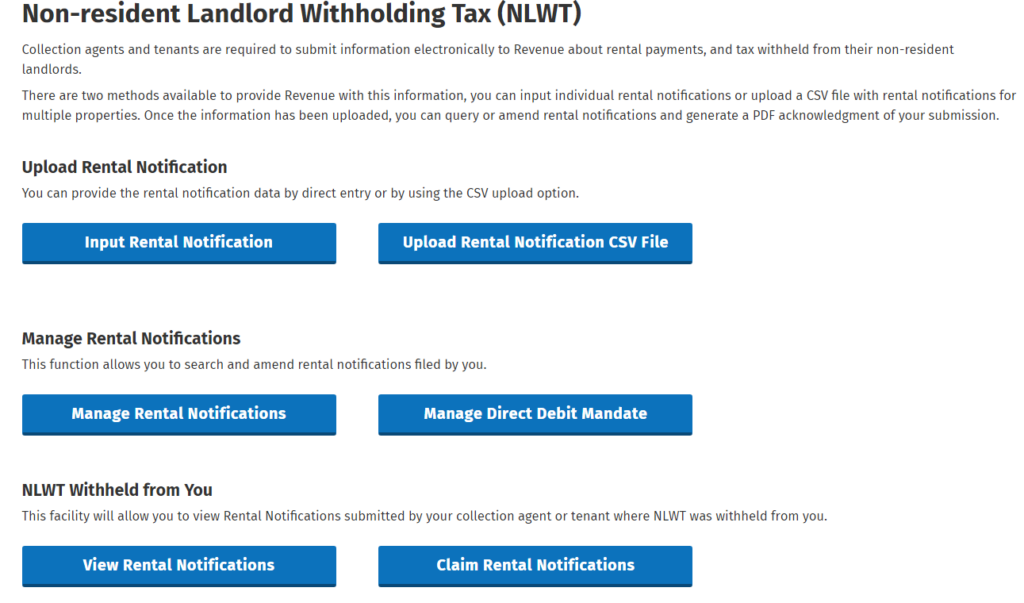

A new non-resident landlord withholding tax system or NLWT as Revenue call it. I know this is not the most thrilling news you’ll hear today, but it’s important if you are in this space. We have non-resident clients who we do this work for. The purpose of the blog is to give you an idea

That nagging 'what if' about your finances? It's costing you growth.