The story of any successful and growing business is not without its twists and turns. With each milestone you reach, and each challenge you overcome, there’s another waiting further down the line.

That’s why it’s always helpful to have the support and guidance of a trusted advisor – particularly one that’s been over the course before.

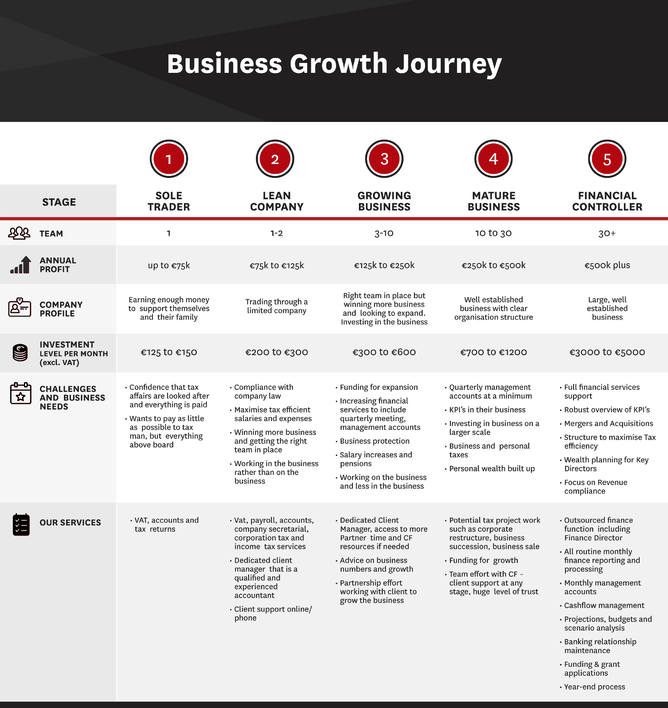

In this blog post, we’ve mapped a typical business journey against the backdrop of its accountancy needs, based on our own experiences guiding clients from startup to scale-up, and beyond. From an individual entrepreneur, through to overseeing a company with 50 plus employees and revenues in the millions, we’ll show you what lies in store.

But first…

A Quick Note on How We Price Our Services

For each of our services, and at every stage of the journey, we always agree pricing up front. Even if there’s additional work to be done as our working relationship develops, we make sure it’s flagged and any fees required are agreed before we proceed.

Trust is vitally important to us, and we can only build that trust between one another if we don’t spring any nasty surprises on you.

So, you have our word: No random bills or charges. No rogue invoices. No nasty surprises! Just transparent and agreed upon pricing. The way it should be.

Now, back to the blog post.

Stage One: Sole Trader or Solopreneur

Typically, this is a one person band just starting out. Whenever we speak with a sole trader, their main concern is usually earning enough money to support themselves and/or their family.

It’s vitally important at this early stage that the correct processes are put in place with regards to tax. They want to sleep easy knowing everything’s looked after, and everything is paid up. However, they also want to ensure they’re paying as little as possible, while keeping everything above board.

Stage Two: Lean Business – Company with 1 or 2 Employees

At this stage, the person has either incorporated after trading as a sole trader with great success, or they’ve launched the limited company from a standing start. Either way, this requires additional levels of service and expertise to ensure the company is compliant with company law.

We offer VAT, payroll, accounts, secretarial, corporation tax, and income tax services to limited companies. And this level of insight gives us the chance to maximise tax efficient salaries and expenses from the company.

For those that have progressed from sole trader to company director, they’ll discover that there are more taxes involved, so it’s important that everything is correct from a Revenue perspective.

In terms of growth aspirations, we typically find that the client is still working “in” the business, as opposed to “on” it. We can help smooth the way to stage three by making sure deadlines are met, upcoming payments are flagged, and cash flow is healthy.

We place a dedicated client manager with each client at this stage. The client can simply pick up the phone and chat with their client manager at any point throughout the year, should they wish to ask a question or discuss an idea.

It’s important to note that the client manager isn’t a wet-behind-the-ears junior, but rather an experienced accountant that knows the client and their business inside out. They will always have the best interests of the client at heart.

Stage Three: Growing Business – 3 to 10 Employees

With the right team of employees in place, and a steady stream of new business, stage three is very much about preparing for expansion.

Clients are now taking a step back from the day-to-day and looking instead at the bigger picture. Where can they invest in the business in terms of staff, marketing, equipment, and premises? And how can they access the funds to do just that?

We can help by identifying funding opportunities, while also offering more services, quarterly meetings, and management accounts. At this point in the business’s growth, we help keep the owner accountable by challenging the numbers and working in partnership to hit key milestones. They’ll still have that dedicated client manager, but they’ll also have access to more partner time and more resources if required.

Stage Four: Mature Business – 10 to 30 employees

At stage four, we’re looking at a well-established business – possibly second or third generation. Profits will be in excess of €250k per year, with a turnover in the region of €2m plus.

The brand is usually well-known in the local community, and could be operating nationwide, while the company has a clear organisational structure.

For a business fitting this profile, we offer quarterly management accounts at a minimum, while also helping the board track key performance indicators (KPIs) and funding opportunities. We also take a greater interest in both personal and business taxes, looking at personal wealth management, corporate restructuring, business succession, and business sales.

There is a huge level of trust between our team and theirs at this point; they can pick up the phone at any time and for any reason.

Stage Five: Powerhouse Business – Financial Controller

Finally, we reach stage five – the powerhouse business. With 50 plus employees, soaring profits, and millions in turnover, the directors have plenty on their plate to worry about. We step in and handle everything a Financial Controller would look after, so they don’t need to hire one in-house at a greater expense.

The outsourced finance function covers all finance director duties, and routine finance reporting, including processing, reconciliations, payroll, invoices, supplier payments, and control. We also offer monthly management accounts, cash flow management (vital for growth), projections, budgets, and scenario analysis.

And to take the weight off the all-action, extra-busy CEO, we can take the lead on grant and funding applications, maintain relationships with the banks, and handle the year-end process, including dealing with any external auditors.

In Summary

Here at Comerford Foley, we’re also on our own business journey. Through personal and client experience, we can help you move through the different stages, working closely together as a partnership. If you put in the hard work, we’ll be right there with you, playing a small part in helping you achieve your business goals.

So, whether you’re starting at stage one and working your way up, or you’re already a few rungs up the ladder, we can offer the right level of support, services, and expertise for you. Leave your tax and accounting concerns aside, and focus on what you do best – running and growing your business.

If you’d like to find out more about how we can help you, contact us today.