Sleep easier at night knowing your business is strong and profitable

Run your business without the guesswork. Grow and achieve your potential with an accounting partnership you can trust in.

Run your business without the guesswork. Grow and achieve your potential with an accounting partnership you can trust in.

We all know life can be unpredictable. As a business owner, you want to build a business resilient enough to thrive in the unpredictability.

Security goes beyond the business. You want to know you have enough money for yourself and your family.

Taking risks and making the most of opportunities feels a lot more exciting when you have a safety net.

You climb the mountain, we’ll thread the rope. That’s how it works to partner with us. You can focus on your strengths, safe in the knowledge we’ve got a firm grip on the finances.

When life throws a curveball, you don’t need to bury your head in the sand. You need a process you can trust in, whatever the situation.

We see business growth as a journey. As your business grows, so will our relationship. We’re always reviewing, to make sure we’re finding the best way of working to achieve your goals.

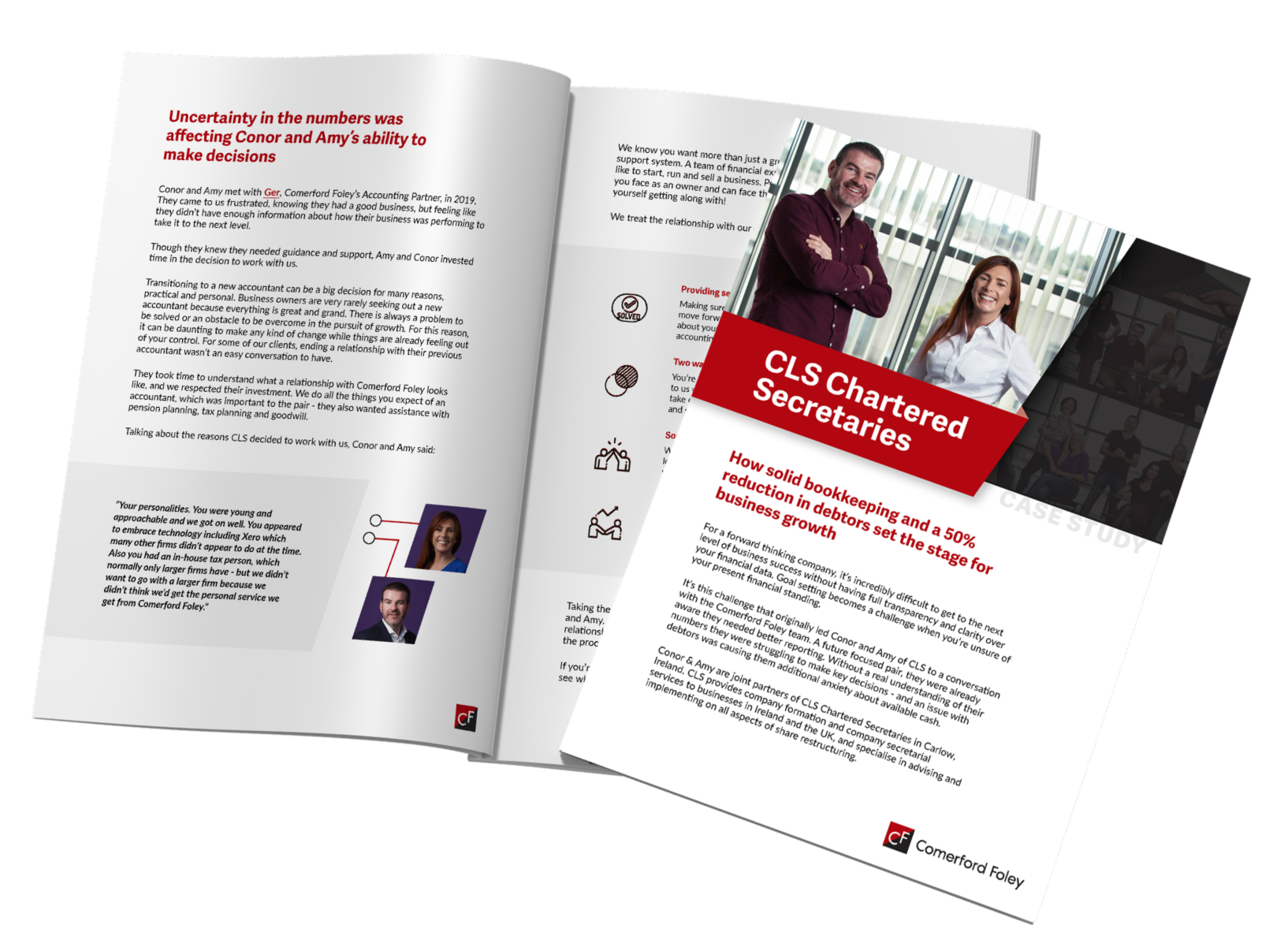

How solid bookkeeping and a 50% reduction in debtors set the stage for business growth

“For us at Channel Meats it’s all about a partnership with Comerford Foley for our growth. They’ve always got our back. As a family business, this loyalty is not only appreciated but critical to our business growth. When our accountants understand how we think, and are willing to work together with us, it means that everything we do together delivers solid value – the kind that has a direct result on our bottom line. We’ve been working with them for several years and in that time we have truly found them to be invaluable to our company.”

– Ted Murphy, Channel Meats